Veteran crypto trader and analyst @olvelez007 took to X on November 23, issuing an optimistic long-term price forecast for Bitcoin (BTC). Specifically, the analyst urges investors, and more so retail investors, to accumulate more BTC while the coin is still affordable.

Based on historical performance, @olvelez007 said Bitcoin is poised for another magnitude leap in valuation that could take the coin to a new level, unreachable for ordinary folks.

Will Bitcoin Rally To 6-Figures After Halving?

On X, the analyst said Bitcoin supporters should “stop slacking,” admonishing any traders yet to reach the elusive full Bitcoin status. “In a very short period of time, the possibility of getting to a full Bitcoin will completely disappear for 99.99% of people,” @olvelez007 warned, citing the expected level of adoption in the coming months.

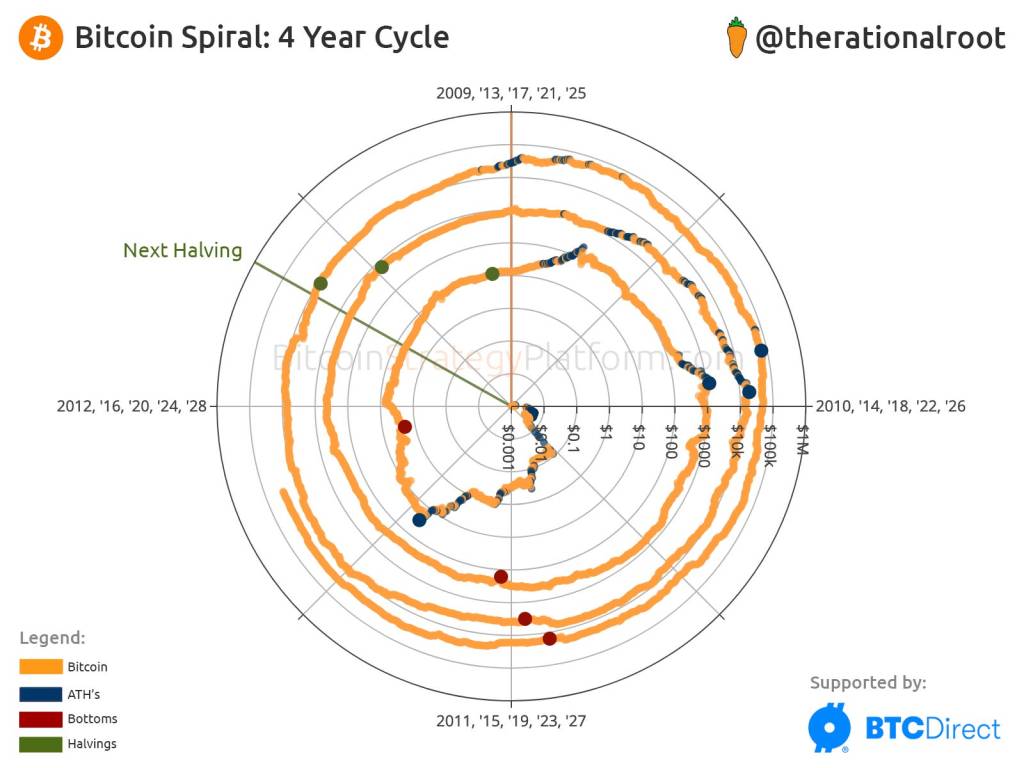

Notably, the trader pointed to Bitcoin’s history of roughly adding another digit as a psychological ceiling every four years, clearly detailing how prices rose from $1, then $10, $100, $1k, and $10k milestones in sequence.

According to the analyst, the Bitcoin price surge parallels mining reward “halving” events adjusting token emission rates. Subsequently, with the next halving expected in April 2024, the trader foresees 6-figure prices for Bitcoin on the way.

In April 2024, Bitcoin is scheduled to have its mining rewards reduced by half. As a result, block emissions will automatically drop from 6.25 BTC to 3.125 BTC, marking the beginning of the fifth epoch for the Bitcoin network.

While this move will help reduce inflation, it is uncertain how Bitcoin miners, who play a crucial role in maintaining network security and processing transactions, will adapt to the change.

Adjusting To Halving And Eyes On SEC

As it is, how Bitcoin prices will perform in the months ahead remains to be seen. However, looking at how the coin has surged in the past few months, there are signals to suggest that BTC may not only break the immediate ceiling at around $40,000 but also soar to retest the $69,000 recorded in the past bull run.

The primary trigger behind this optimistic outlook is the expected approval of the first batch of spot Bitcoin exchange-traded Funds (ETFs) in the United States. Already, among the applicants’ rooster include Wall Street heavyweights, including BlackRock and Fidelity.

Hopes of the Securities and Exchange Commission (SEC) approving the first spot Bitcoin ETF is responsible for driving Bitcoin from around $25,000 to above $32,000 and to the present mark, trending above $37,000.