In a thread on August 19, analyst Miles Deutscher argued that MicroStrategy’s market-implied net asset value (mNAV) premium—the core gear in Michael Saylor’s Bitcoin acquisition flywheel—has compressed sharply, weakening the feedback loop that helped the company outpace Bitcoin through most of the cycle. “Michael Saylor built the craziest BTC flywheel in history. But his buying power is starting to fade. The market is now asking one question: ‘Is the BTC treasury bubble finally popping?’”

MicroStrategy’s Bitcoin Premium Is Fading

Deutscher grounds the discussion in how investors currently value MicroStrategy. “People often overlook that MicroStrategy has a legacy software business, which continues to generate revenue. However, MicroStrategy has essentially become a company whose valuation is primarily influenced by its BTC holdings. The entire system is powered by mNAV (Market-Implied NAV).”

In practical terms, the mNAV multiple is the premium investors pay over the company’s look-through Bitcoin value to access leveraged BTC exposure via MSTR. “An mNAV of ~1.58x means the market is paying a 58% premium for their BTC.” According to Deutscher, that premium “was once a 3.4x mNAV” when Bitcoin was surging, but it has “now decreased to 1.58x. Demand is slowing down.” In other words, what had been a powerful flywheel—high premium enabling cheap equity issuance that funded more Bitcoin purchases, which in turn kept NAV rising and the premium elevated—now spins with much less torque.

That shift intersected with a contentious corporate action. “Recently, Saylor sparked controversy by revealing that Strategy had revised its MSTR Equity ATM Guidance to offer greater ‘flexibility’ in executing its capital markets strategy.” The implication, Deutscher argues, is that greater issuance flexibility “may dilute shareholder value and increase financial risk tied to Bitcoin’s volatility.”

He notes that “the market is quite divided” on the change. On the constructive side, he quotes @thedefivillain’s take—“Slower concentration of supply in Saylor’s hands,” “Greater leverage to justify mNAV,” and “Reduced buying pressure for BTC in dollar terms”—as reasons the revision could ultimately be benign.

But critics worry about “the possibility of a ‘death spiral.’ The removal of the 2.5x mNAV safeguard for equity issuance may allow MicroStrategy to sell shares at lower valuations.” Reflexivity, in Deutscher’s telling, is the operative risk factor: “Reflexivity is a brutal force that operates in both directions.”

A Hypothetical Scenario

Deutscher then sets up a stress-test to illustrate how that reflexivity could bite if Bitcoin weakens and the premium compresses to parity. “If BTC’s price drops 20% and MicroStrategy’s mNAV multiple falls to 1.0x, the stock might plummet by 46.5%.”

He walks through the arithmetic from a notional baseline of $115,000 per BTC, which on a 20% decline would fall to $92,000. On MicroStrategy’s “226,331 BTC,” he calculates that would put look-through NAV at $20.82 billion.

To align an mNAV of exactly 1.0x, he backs into enterprise value and market cap under that scenario: “Starting with an enterprise value of $20.82 billion, we subtract MicroStrategy’s $2.2 billion in debt and add its $0.1 billion in cash. This calculation unveils the company’s market cap, hitting $18.72 billion, a significant pullback from its original $35 billion market cap.”

The conclusion he draws from the modeled path—BTC −20% to ~$92,000, mNAV → 1.0x, MSTR market cap −46.5%—is that MicroStrategy’s equity remains a leveraged instrument with an outcome path that can be materially worse than Bitcoin itself when the premium compresses.

Beyond the scenario math, Deutscher links recent spot price action to changing marginal demand. “I think BTC’s recent weakness can be attributed to the market starting to price in reduced Saylor demand/tail potential risk of the revised ATM guidance.”

In parallel, he highlights how the proliferation of spot ETFs erodes the original rationale for paying a large listed-company premium to own BTC “beta”: “Spot Bitcoin ETFs are plentiful now. Why would you pay a 58% premium for MSTR’s leveraged exposure when you can grab IBIT at a clean ~1.0x NAV?”

By his framing, the mNAV premium itself “was indicative of the market’s view that MSTR was going to outperform BTC.” With that view fading, the premium looks less like an enduring structural feature and more like a belief-sensitive variable. “In my opinion, the MSTR premium is essentially a gamble. You’re betting on three fragile things: unwavering market confidence, open capital markets, and Saylor’s leadership. If any of those pillars start to wobble, the premium collapses.”

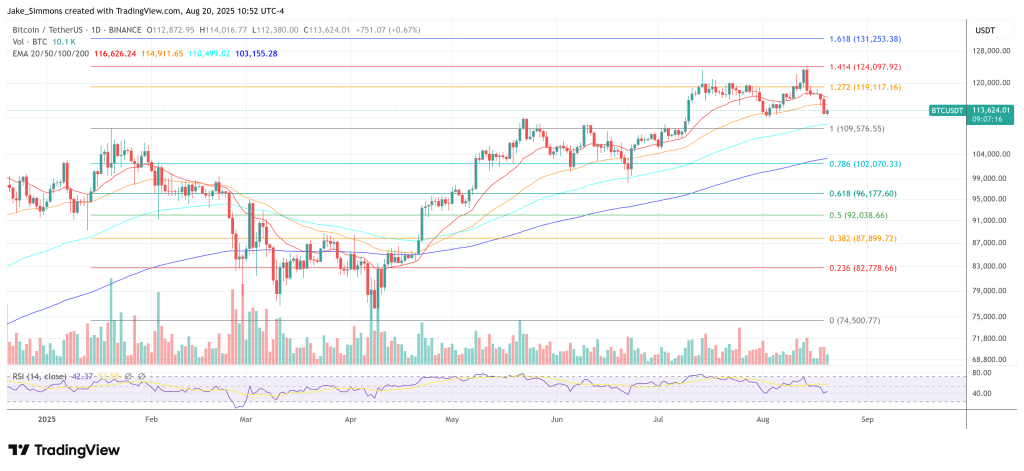

At press time, BTC traded at $113,624.