Crypto investment products continued to attract capital for the fourth consecutive week, according to the latest weekly report from CoinShares, a European-based asset manager focused on digital assets.

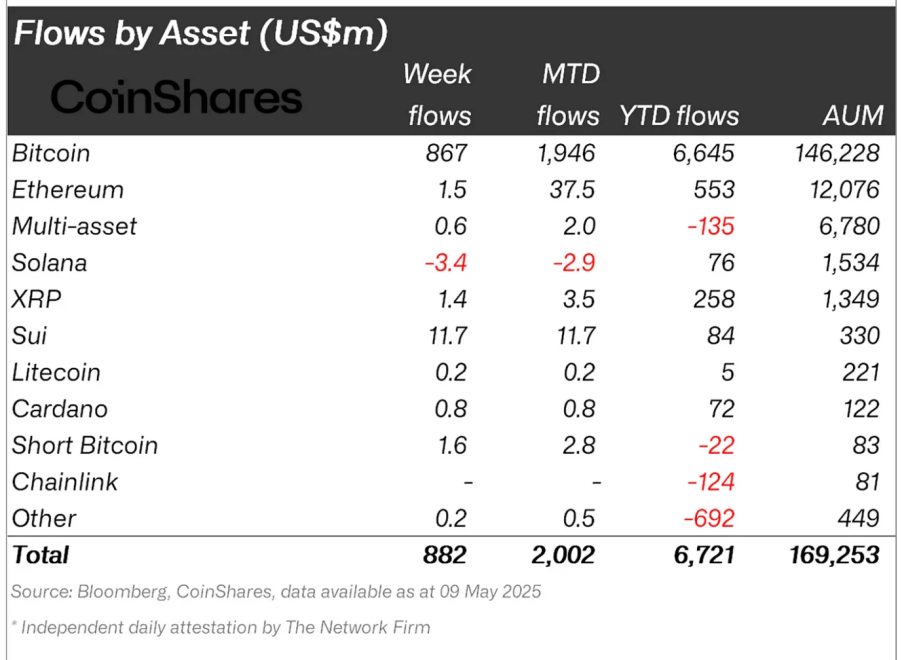

The data revealed that inflows totaled $882 million globally last week, bringing year-to-date figures to $6.7 billion—just shy of the previous peak of $7.3 billion recorded in early February 2025.

Bitcoin Leads Inflows; Sui Overtakes Solana

Bitcoin remains the dominant choice for investors, attracting $867 million in inflows last week alone. US-listed Bitcoin ETFs crossed a new milestone with cumulative net inflows of $62.9 billion since their debut in January 2024.

This surpasses the previous high of $61.6 billion from earlier this year, reinforcing the role of institutional vehicles in driving Bitcoin demand.

In contrast, Ethereum’s performance was relatively subdued despite recent price appreciation. ETH products recorded only $1.5 million in inflows for the week, a marginal figure compared to Bitcoin.

Meanwhile, alternative layer-1 protocol Sui saw an influx of $11.7 million, pushing its year-to-date total to $84 million, eclipsing Solana’s $76 million. Notably, Solana saw $3.4 million in outflows over the same period, suggesting a rotation of capital into newer blockchain networks.

The ongoing rise in capital allocations comes amid a backdrop of rising macroeconomic uncertainty. CoinShares’ Head of Research, James Butterfill, attributes the surge in digital asset inflows to several converging factors.

These include a global increase in M2 money supply, concerns over stagflation in the United States, and recent policy moves by US states recognizing Bitcoin as a strategic reserve asset. The combination of these developments appears to be reinforcing institutional interest in crypto exposure.

Regional Breakdown and Broader Trends

Regionally, the United States led all markets with $840 million in inflows, followed by Germany with $44.5 million and Australia with $10.2 million. Canada and Hong Kong, by contrast, posted modest outflows of $8 million and $4.3 million, respectively.

The geographical divergence may reflect varying levels of investor sentiment, regulatory clarity, and institutional product availability across jurisdictions.

The CoinShares report also hinted at the rising role of macroeconomic drivers in crypto investment strategies. The report noted that institutional investors are increasingly treating digital assets as a hedge against fiat depreciation and economic volatility.

This view is being reinforced by developments like state-level legislation in the US acknowledging Bitcoin as a reserve asset and the broader uptick in fiat liquidity.

While Bitcoin continues to dominate flows, the performance of newer assets such as Sui highlights growing interest in blockchain infrastructure alternatives. If this trend persists, fund managers may increasingly diversify beyond the traditional top two digital assets in their product offerings and investor outreach strategies.

Featured image created with DALL-E, Chart from TradingView