On Wednesday, the US Federal Reserve decided to leave its benchmark interest rate unchanged in the 4.25%–4.5% range – and Bitcoin reacted instantly. The pause, while widely anticipated, came with a slightly revised outlook that includes a slower timeline for future rate cuts and a notable adjustment to the central bank’s balance sheet reduction pace.

According to the Federal Open Market Committee (FOMC) statement, the Fed’s “Dot Plot” now indicates only two 25 basis-point rate cuts for this year—fewer than many market participants expected in December. Policymakers stressed that while interest rates remain in restrictive territory, the timing of actual cuts hinges on the path of economic indicators, particularly inflation and employment.

However, the latest statement no longer asserts that inflation and employment are “in balance,” reflecting the Committee’s growing concern about economic uncertainty. But perhaps the most significant pivot was the Fed’s announcement that it will slow the reduction of its bond holdings, commonly known as “quantitative tightening” (QT).

Beginning in April, the monthly runoff for government bonds will drop from $25 billion to $5 billion—a substantial downshift that many analysts consider a prelude to a more accommodative stance if economic or market conditions deteriorate.

What This Means For Bitcoin

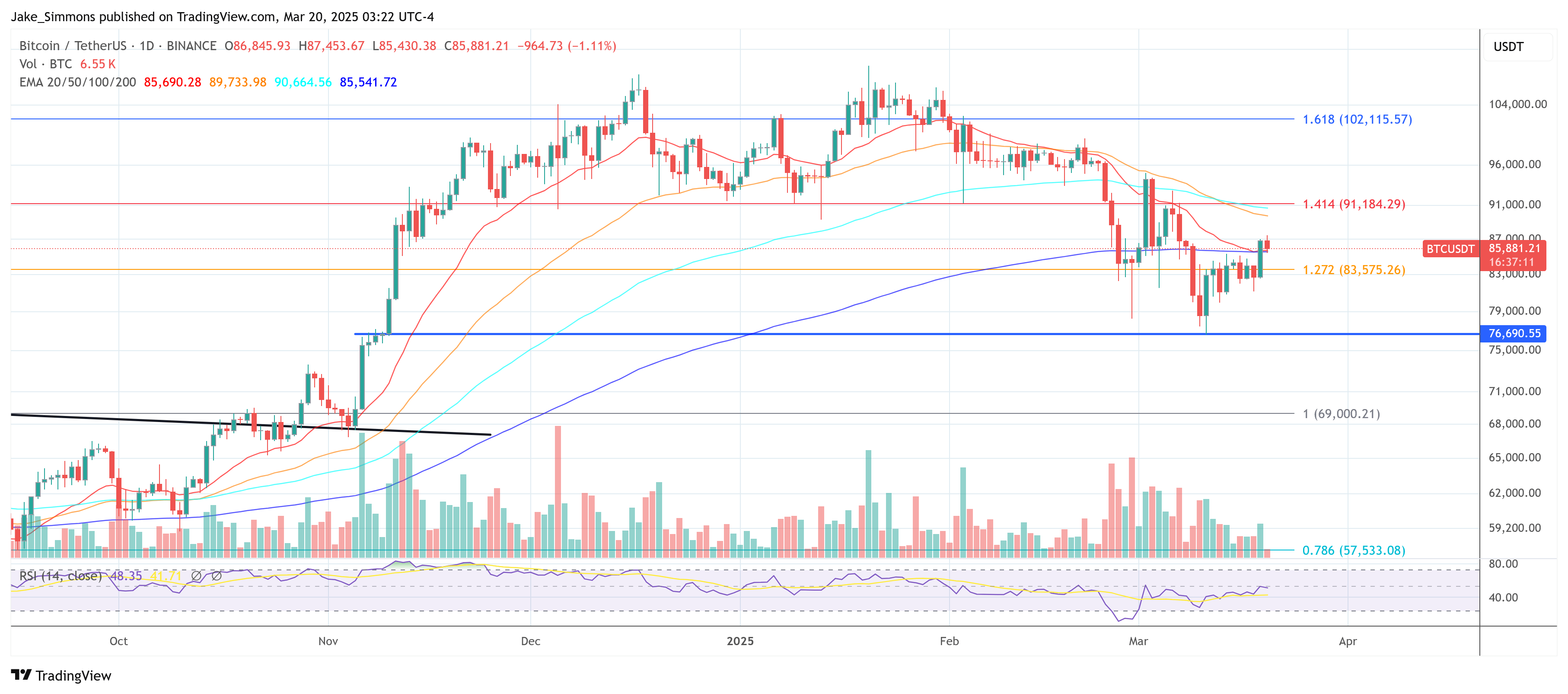

Shortly after the Fed’s announcement, Bitcoin rallied roughly 4–5%, briefly surpassing the USD 86,000 level. Nik Bhatia—founder of The Bitcoin Layer and author of Bitcoin Age—took to his latest video update to dissect the decision’s implications. “Bitcoin up 4% on the news that the Fed slows QT and is still committed to cutting interest rates,” Bhatia said at the start of his analysis, noting that the market had been laser-focused on whether the central bank would modify its quantitative tightening approach.

Bhatia explained how the reduction of the monthly runoff cap from $25 billion to $5 billion can loosen liquidity constraints in the overall system: “Now the Fed is also still contracting its balance sheet, but now it will do so by only five billion a month as opposed to 25 billion a month, and that is a material change,” he said.

“This isn’t some, ‘Hey, we’re on the cusp of QE now just ‘cause we went from 25 to a five,’ but the first step is to get the balance sheet to stop shrinking … so that if the Fed needs to pivot, it can go quickly from 5 billion in QT a month to some modest expansion.”

Bhatia underscored that such a move can fuel market risk appetite: “The market sees the Fed for what it is: it supports credit creation which expands balance sheets across the world, and that flow ends up in asset prices … some of those assets can be stocks, Bitcoin—[and] other financial assets.”

Other experts are even more drastic in their assessment. BitMEX co-founder Arthur Hayes stated via X: “JAYPOW delivered, QT basically over Apr 1. The next thing we need to get bulled up for realz is either SLR exemption and or a restart of QE. Was BTC $77k the bottom, prob. But stonks prob have more pain left to fully convert Jay to team Trump so stay nimble and cashed up.”

Jamie Coutts, Chief Crypto Analyst at Realvision, pretty much agrees: “After last night, QT is effectively dead (for some time). Treasury volatility has backed right off and is now mirroring the decline in DXY from earlier this month. This is all extremely liquidity-positive.”

At press time, Bitcoin traded at $85,881.