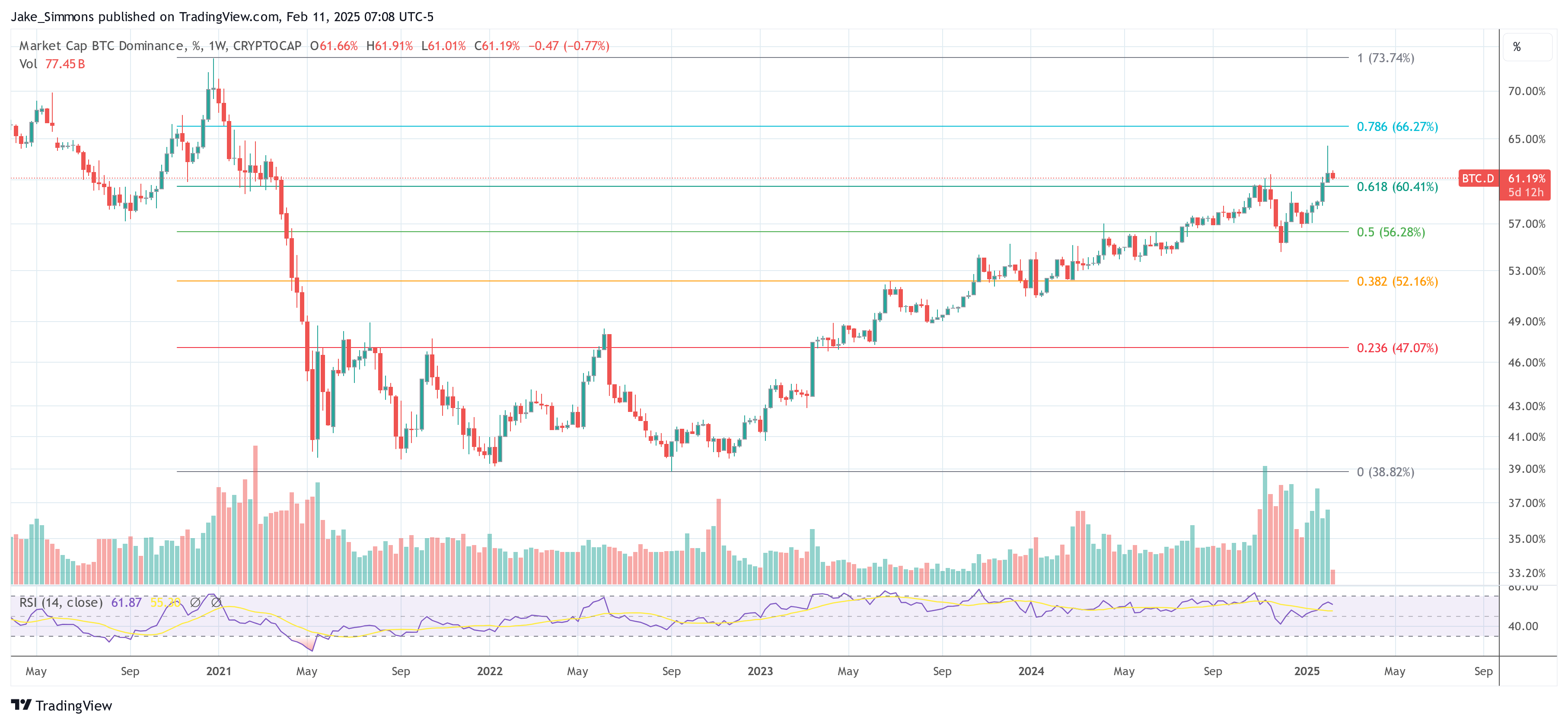

The Bitcoin dominance (BTC.D) surged above 64% this week, its highest level since March 2021, sparking debate over an impending short squeeze that could send its price skyward. The stark warning comes from Joe Consorti, Head of Growth at Theya, who took to X on Monday to outline what he views as a decisive turning point for Bitcoin versus the rest of the digital asset market.

A Historic Break In Bitcoin’s Correlation Patterns

In his post, Consorti contends that Bitcoin’s recent price action marks the first time in its 16-year history that both its price and market dominance have risen in tandem. Historically, Bitcoin’s dominance would rise initially, only to wane as speculation spilled into altcoins. However, Consorti states: “This is the first time in history that bitcoin’s share of the total digital asset market is rising while its price is climbing. In past cycles, retail-driven speculation pushed bitcoin’s price up and later funneled money into altcoins, causing bitcoin dominance to decline. That dynamic is gone.”

According to Consorti, the days when a broad altcoin rally would follow Bitcoin’s initial surge appear to be over. Bitcoin dominance recently touched 64%—its highest level since February 2021. Consorti attributes the phenomenon to a significant change in market participation: “This cycle, institutions, sovereigns, and long-term holders are leading the charge, increasingly allocating capital exclusively to bitcoin while largely ignoring the rest of the market.”

Last week’s market turbulence resulted in what Consorti calls “the single-largest liquidation event in ‘crypto’ history,” citing data that more than $2.16 billion in positions were wiped out within 24 hours. Ethereum led the liquidation figures with $573 million, and the largest single liquidation—a $25.6 million ETH/BTC order—occurred on Binance. “As you might have guessed, ETH/BTC is not having a great time,” Consorti notes, pointing out that the ETH/BTC pair is trading at 0.026—its lowest level in over three years.

He argues these liquidations highlight the precarious nature of heavily leveraged altcoin markets: “All of it wiped out in an instant when price moved against them. This wasn’t your standard technical correction, it marks the start of an extinction-level event for altcoins.”

The “Altcoin Casino” In Crisis

Consorti’s analysis suggests that what he dubs “the altcoin casino” is now collapsing. He points to failed narratives around popular projects—Ethereum, Solana, and DeFi among them—that have struggled to maintain investor confidence: “Altcoins have survived purely on narratives. Each cycle, a new batch of narratives emerged, promising world-changing innovation. None of them lasted.”

He contrasts this with Bitcoin’s core value proposition, which, in his view, requires no marketing: “Bitcoin, on the other hand, doesn’t need a narrative. It doesn’t need marketing or hype. It exists, and it thrives because it was built to do one thing—protect wealth in a world of perpetual monetary expansion.”

Consorti also references Ethereum’s “merge” and its supposed deflationary design, pointing out that since the upgrade, ETH’s total supply has increased by 13,516 ETH—undermining the “ultra-sound money” claim.

Adding a policy dimension to the market’s transformation, Consorti highlights a statement from Senator John Boozman during the White House Crypto Working Group’s first press conference: “Some digital assets are commodities, some are securities.”

This, he suggests, is a tacit acknowledgment that Bitcoin stands apart from other digital assets. In a further development, Consorti cites a comment from White House AI & Crypto Czar David Sacks, who mentioned the group is evaluating the viability of a Strategic Bitcoin Reserve—a shift from the previous “National Digital Asset Stockpile” terminology used under a Trump-era executive order.

Consorti frames this as a “major development” that signals growing recognition of Bitcoin’s unique properties: “This language shift is monumental. A few years ago, the US government was openly hostile toward bitcoin. Today, they’re discussing stockpiling it.”

Amid this upheaval, Consorti suggests that the next dramatic move in Bitcoin could be an explosive short squeeze. Funding rates on perpetual futures, he notes, have gone “deeply negative,” reminiscent of when Bitcoin traded near $23,000 in August 2023. This implies a tilt in leverage toward traders betting against Bitcoin—a position that could rapidly unwind: “While last week’s leverage flush wiped out most long positions, the next major move could be the opposite—an explosive rally fueled by forced short liquidations.”

Should the market turn against these short-sellers, the forced buy-backs could drive the price higher with unusual speed and volume—especially if overall liquidity remains thin. He concluded, “Traders who overextended their leverage to short bitcoin will eventually have to buy it back when the price moves against them, just like overleveraged longs were wiped out last week. Bitcoin is coiled. The stage is being set for a potential short squeeze. The longer this dynamic of short dominance persists, the greater the risk of a forced shirt liquidation cascade that sends bitcoin’s price higher with force.”

At press time, BTC.D stood at 61.19%.