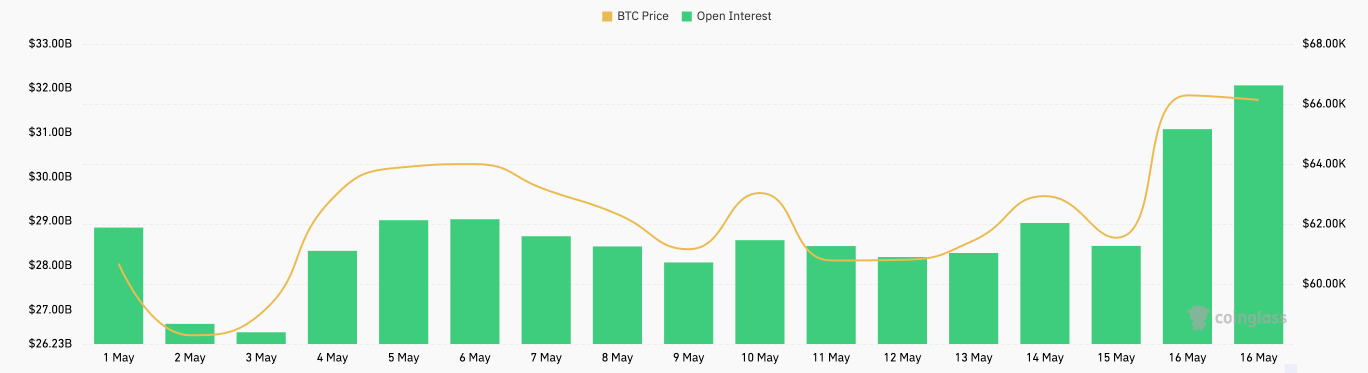

Bitcoin regained the $66,000 level in the night between May 15 and May 16, recovering some of the losses it incurred in the past week. This spike substantially impacted the derivatives market, significantly influencing both open interest and trading volume.

Futures open interest, which indicates the total value of outstanding futures contracts yet to be settled, experienced a marked increase. On May 15, futures open interest stood at $28.45 billion but surged to $31.18 billion by May 16. This represents a substantial increase of approximately 9.6%. This rise suggests a growing investor interest in Bitcoin futures, driven by the anticipation of further price movements. The rise in OI is essential as it shows an influx of new capital into the market, signaling traders’ expectations and potential price direction.

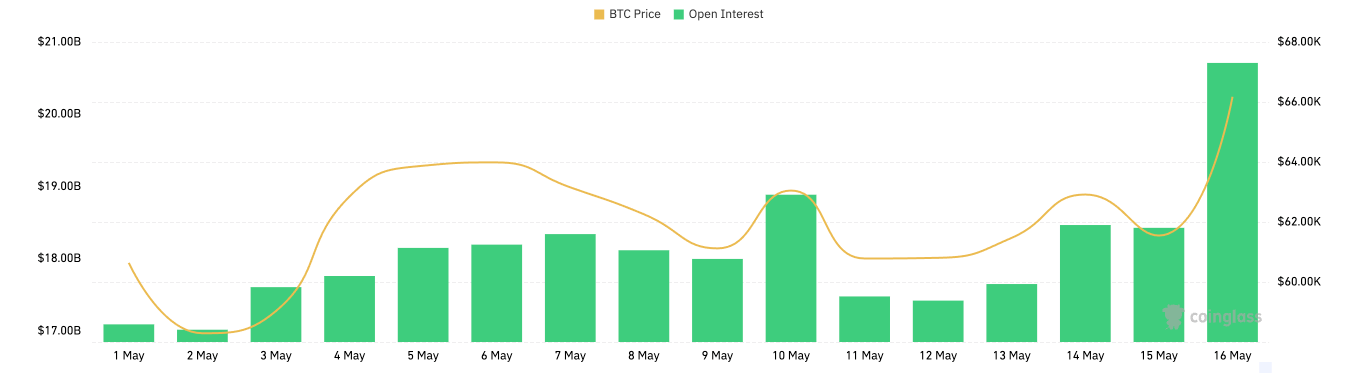

In the options market, open interest also saw a significant uptick. On May 15, options open interest was $18.43 billion, rising to $20.71 billion by May 16. This increase of approximately 12.4% highlights the heightened activity and interest in options contracts as traders positioned themselves for the price surge.

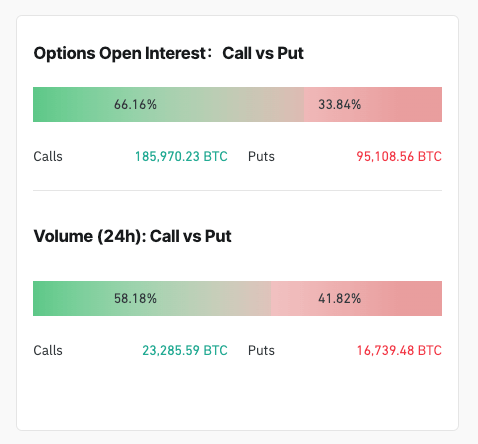

The distribution of options open interest on May 16, with calls accounting for 66.16% and puts for 33.84%, indicates a bullish sentiment among traders, expecting further upward movement in Bitcoin’s price. A deeper look at the options volume further confirms the overwhelmingly bullish sentiment. On May 16, the volume of call options constituted 58.18%, compared to 41.82% for puts, showing that traders were predominantly betting on the price increase.

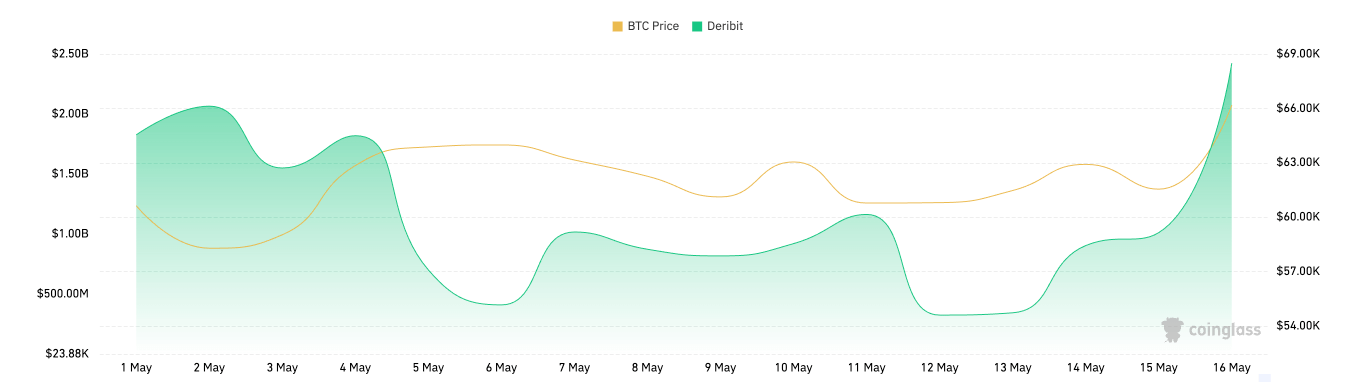

Deribit’s daily options volume dramatically increased, jumping from $1.01 billion on May 15 to $2.42 billion on May 16.

The volume and distribution between shorts and longs provide further insights into the state of the market. On May 16, the total liquidations amounted to $150.52 million, with long liquidations at $40.76 million and short liquidations at $109.76 million. The significantly higher short liquidations indicate that many traders were caught off guard by the price increase, resulting in the forced closure of short positions. This liquidation asymmetry reinforces the bullish trend observed during this period, as shorts were squeezed out of the market.

Analyzing the changes in OI and volumes is crucial for understanding how the derivatives market responds to price movements. Once a niche market catering to a small subset of sophisticated investors, Bitcoin derivatives have grown to become a market foundation. The tens of billions in open contracts across products show that derivatives are significant and important enough to affect the broader crypto market.

Data from CoinGlass indicates a growing bullish sentiment among traders, with a notable preference for call options and a high volume of short liquidations. This behavior suggests that traders are positioning for further price appreciation in Bitcoin. If this bullish sentiment persists and is supported by continued positive price action, we may see further increases in open interest and trading volumes, potentially driving Bitcoin’s price higher.

The post Derivatives saw spike in Open Interest and volume as Bitcoin broke $66k appeared first on CryptoSlate.