Richard Byworth, Managing Partner at SyzCapital, has ignited rumors suggesting that Bitcoin ETFs listed in Hong Kong could soon be accessible to investors from mainland China. Byworth’s remarks on X, formerly known as Twitter, highlight the ongoing discussions about the possibility of the integration of these ETFs into the Stock Connect system. This integration could pave the way for a massive wave of capital inflow from the mainland into these digital asset funds.

Byworth stated, “I just got back from Hong Kong. There is talk that the ETF could be added to stock connect. The implications for this are absolutely enormous (basically means mainland money can buy it)”. This statement followed a dialogue initiated by Samson Mow, who commented on the impressive initial performance of the ChinaAMC Bitcoin ETF, which gathered $121 million on its first trading day.

Bitcoin ETF In Hong Kong To Open For Mainland Chinese?

Mow’s statement, “I think you guys should be a little more bullish,” reflects an optimistic outlook on the future of Bitcoin ETFs in Hong Kong. Adding depth to the discussion, Brian HoonJong Paik, Co-founder & COO at SmashFi, expressed his views on the financial and socio-economic motivations that could drive mainland Chinese interest towards Hong Kong’s Bitcoin ETFs.

He highlighted the vast amount of Chinese wealth locked in real estate, with approximately 100 million empty homes, pointing to a dire need for alternative investment opportunities to stabilize the socio-economic landscape. “It’s just a matter of time. The CCP needs an alternative asset to mitigate social unrest,” Paik stated.

Paik also tackled the widespread misconception that investors from mainland China are currently restricted from investing in ETFs available on the Hong Kong Stock Exchange. He explained that several existing financial arrangements already facilitate a robust flow of mainland capital into Hong Kong’s markets.

The Shanghai-Hong Kong Stock Connect and the Shenzhen-Hong Kong Stock Connect are prominent examples, allowing investors to trade stocks across the border, albeit regulated by a daily transaction quota.

Further, the Qualified Domestic Institutional Investor (QDII) scheme permits Chinese institutional investors to participate in overseas markets, including those in Hong Kong. Additionally, Chinese residents have the option to invest through brokerage firms that operate legally in both territories, navigating the complex regulatory landscape that governs foreign investments.

Another critical framework, the Mutual Recognition of Funds (MRF) between Hong Kong and Mainland China, facilitates the distribution of eligible mutual funds in each other’s markets through a streamlined approval process. According to Paik, excluding Bitcoin ETFs from these arrangements would likely provoke significant discontent and could disrupt the investment landscape in both regions.

“These mechanisms make the Hong Kong stock market one of the most accessible foreign markets for Chinese investors, promoting financial integration between the Mainland and Hong Kong. Excluding only the Bitcoin ETF would likely cause significant repercussions among both institutional and retail investors in both China and Hong Kong,” he stated.

Notably, Singapore-based Matrixport already projected in mid-April that the approval and subsequent inclusion of Hong Kong-listed Bitcoin Spot ETFs into the Southbound Stock Connect could attract $25 billion of capital. This program facilitates up to 500 billion RMB ($70 billion) per year in transactions.

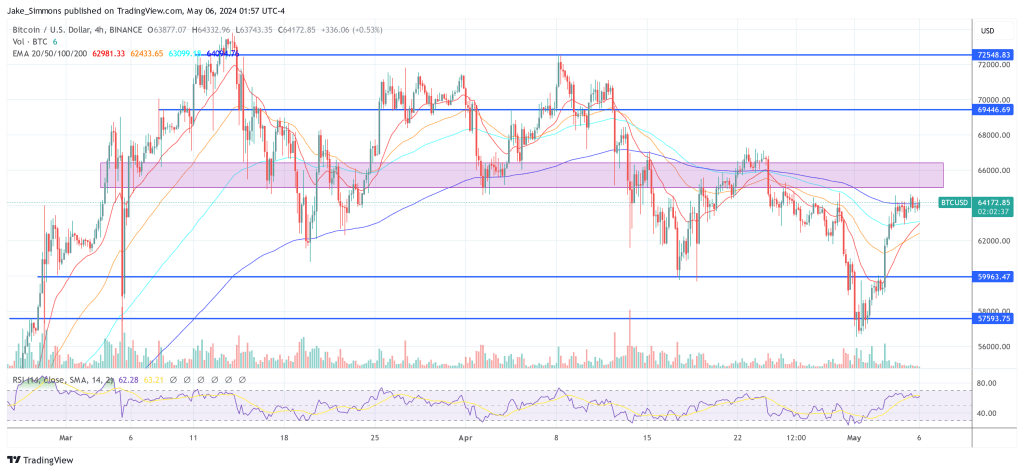

At press time, BTC traded at $64,172.