The post MVRV 30-D Turned Positive: Is Injective Price 20% Jump Just a Start? appeared first on Coinpedia Fintech News

The Injective price isn’t moving quietly anymore. It just ripped 20% intraday, and no, this isn’t one of those random pumps out of nowhere. There’s capital behind it. Real capital.

Pineapple Financial (NYSE: PAPL) has accelerated its INJ buying spree, announcing another $2 million acquisition on February 19, 2026, under its ongoing market cash purchase program. That pushes its treasury play deeper into the Injective ecosystem and signals this isn’t a one-off headline grab.

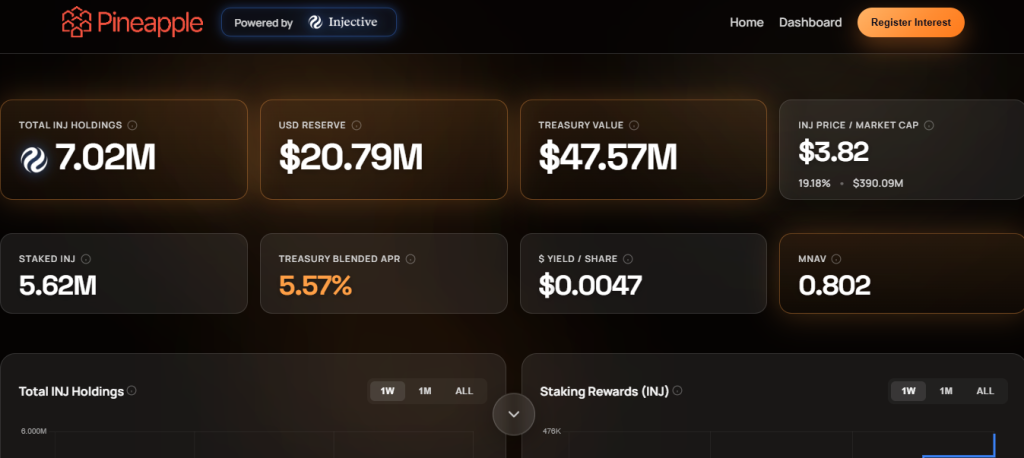

The firm now holds 7.02 million INJ tokens, according to its DAT dashboard. Oh, and it’s sitting on $20.79 million in capital reserves for continued accumulation. Conviction? They say it hasn’t changed.

Pineapple Expands Injective-First Treasury Strategy

Let’s not sugarcoat it but public equity treasury strategies buying crypto isn’t exactly new. But Pineapple positioning itself around Injective specifically? That’s deliberate.

This isn’t just passive exposure. It’s active open-market buying. The company is building around INJ crypto as a strategic asset, and its reserves suggest it’s not done yet.

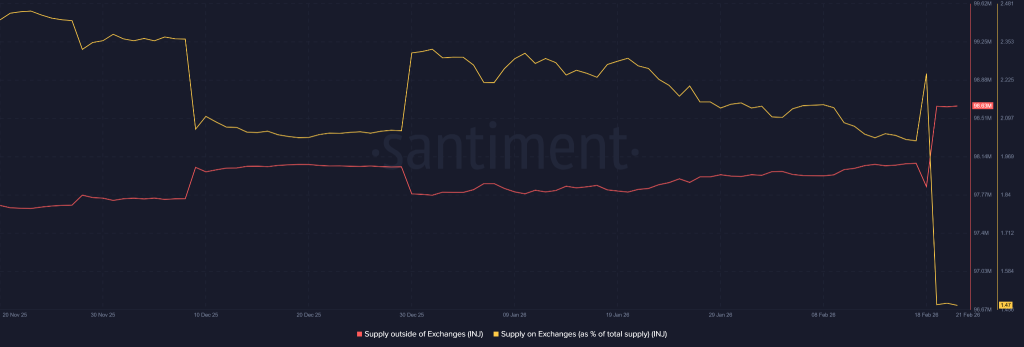

Meanwhile, supply dynamics are tightening. Onchain data highlights that the exchange balances have dropped. Supply outside exchanges climbed to 98.63 million INJ from this week’s low of 97.90 million. That’s accumulation behavior. Whether you’re watching the Injective price chart or on-chain dashboards, the direction is clear: coins are leaving exchanges.

Injective Price Reacts to Buybacks and Burn

Now here’s the main delight. This week saw INJ community BuyBack that completely, burning approximately 54,999 INJ permanently. Deflationary mechanics plus treasury accumulation? That’s not a bad combination if you’re building a bullish narrative.

Adding to that a newly approved proposal, IIP-620, introducing a technical blockchain upgrade. Dynamic gas fees will now be capped within a logically aligned range relative to minimum gas price,which in simple terms, fewer wild fee spikes during congestion.

More predictability. Less chaos. Markets noticed. When writing, the INJ/USD pair is currently trading at $3.86, giving the network a $386 million market cap. And yes, that 20% intraday surge followed weeks of steady bullish developments.

Falling Wedge Signals Injective Price Breakout?

Technically speaking, there’s a 24-month compressed falling wedge pattern reacting bullishly this week. If the upper boundary breaks, short-term targets point toward $8.00. That’s the immediate level being watched for Q1 2026.

Stretch that scenario further and some are eyeing $20 longer term, though let’s be real, that won’t happen overnight.

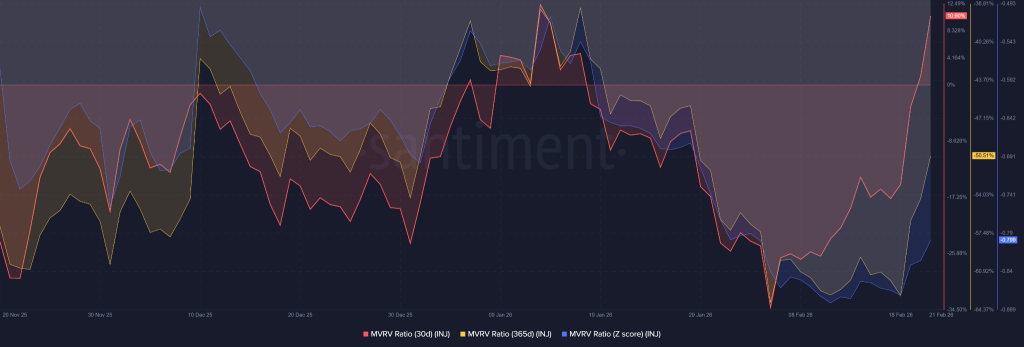

On-chain metrics? Mixed, but improving.

30-day traders are back in profit based on MVRV 30-D. Longer-term 365-day holders are still underwater. The MVRV Z-score sits negative at 0.799, but it’s curving upward. Recovery mode, not euphoria.

So where does this leave the Injective price prediction narrative?

Somewhere between disciplined accumulation and a potential technical breakout. If the wedge gives way and treasury buying continues, the $8 test could come sooner than skeptics expect. For now, the Injective price is doing what bulls have been waiting months to see, it’s finally reacting and follow through depends on further accumulation demand.