Quantum computing has become the latest all-purpose explanation for Bitcoin’s recent drawdown, but NYDIG says the numbers don’t back the narrative. In a Feb. 17 research note, NYDIG research head Greg Cipolaro argues that “quantum fears” are loud, but not a primary driver of the sell-off when you look at search behavior, cross-asset correlations, and broader risk positioning.

Quantum Panic Didn’t Sink Bitcoin

NYDIG frames “Cryptographically Relevant Quantum Computers” as the theoretical endgame risk investors keep circling. The problem is that market behavior doesn’t look like a repricing of an imminent existential threat.

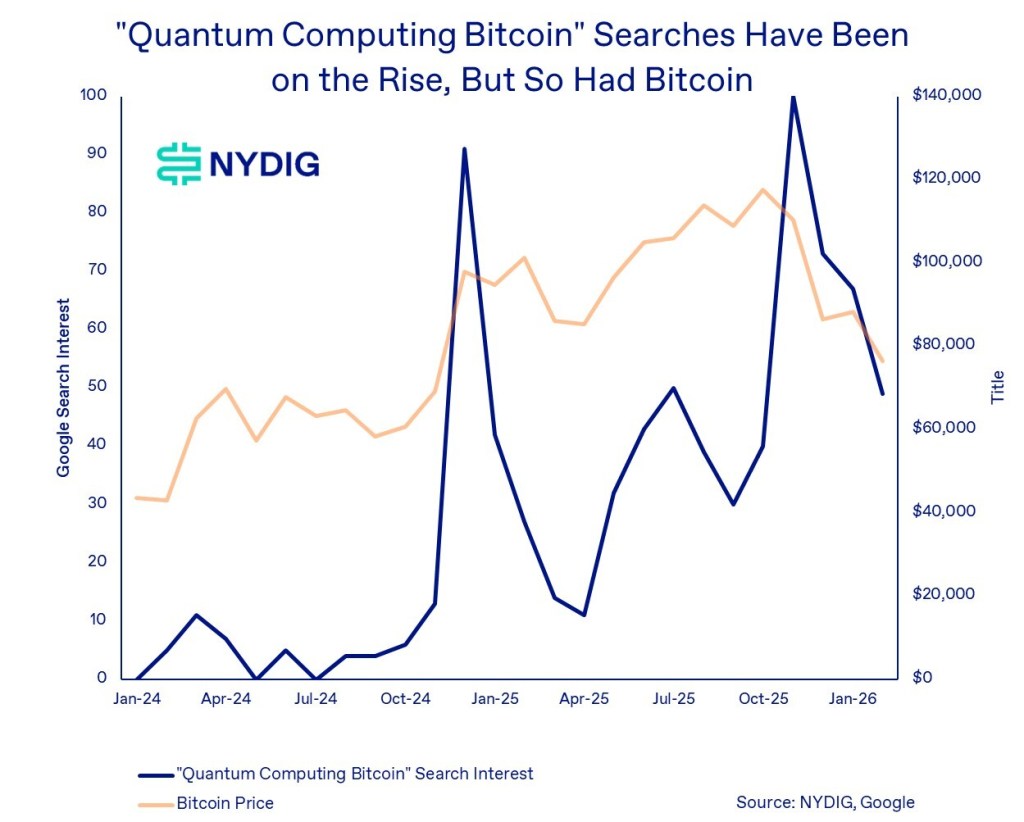

First, Cipolaro points to Google Trends. Search interest for “quantum computing bitcoin” did rise, he wrote, but the timing matters. “Search interest for ‘quantum computing bitcoin’ has risen, but notably this occurred alongside bitcoin’s rally to new all-time highs, not ahead of sustained weakness,” the note said.

“In other words, heightened searches about quantum risk coincided with price strength rather than weakness. If the market were repricing bitcoin on an imminent technological threat, we would expect search intensity to lead or amplify downside risk, not accompany a period of gains.”

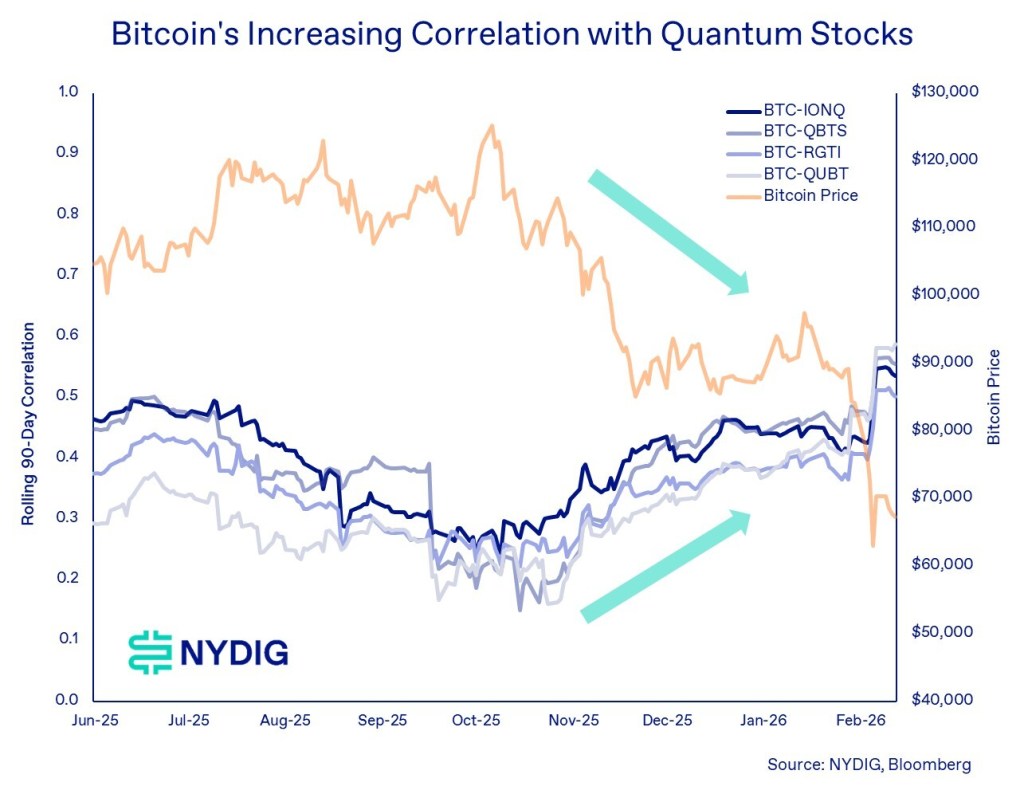

Second, NYDIG looks at how Bitcoin traded versus publicly listed quantum computing equities, specifically IONQ, QBTS, RGTI, and QUBT. If investors were rotating out of Bitcoin because quantum advances were “catching up,” you would expect quantum-linked stocks to diverge positively as Bitcoin falls. NYDIG says it saw the opposite. Bitcoin was positively correlated with those equities, and those correlations strengthened during the drawdown, suggesting a shared driver rather than a direct quantum-to-Bitcoin causality.

NYDIG’s conclusion is blunt on that point. “The data provides no evidence that quantum computing is the proximate cause of bitcoin’s weakness, even if it is the dominant risk narrative at the moment,” Cipolaro wrote. “The more plausible explanation is a broader macro repricing of risk across long-duration, expectation-driven assets. Bitcoin’s recent drawdown appears more consistent with shifts in overall risk appetite than with any discrete technological catalyst.”

The mechanism NYDIG highlights is familiar to anyone watching liquidity regimes. Quantum computing firms, it argues, are long-duration, expectation-driven assets with minimal revenues and high EV/revenue multiples. Bitcoin, while structurally different, often trades as a long-duration bet on future adoption and monetary dynamics. When risk appetite contracts, both can get hit together.

Meanwhile, NYDIG flags a divergence in derivatives markets that, in its view, better captures the current tape than quantum headlines. The 1-month annualized basis on CME has “persistently traded above” Deribit, which NYDIG uses as a proxy for onshore US institutional positioning versus offshore positioning.

Structurally higher CME basis implies US desks have remained more constructive, while the sharper decline in Deribit’s 1-month basis points to rising caution offshore and reduced appetite for leveraged long exposure.

At press time, Bitcoin traded at $66,886.