Institutional investors are ramping up their exposure to digital assets following the US Federal Reserve’s recent rate cut. The latest CoinShares Digital Asset Fund Flows Weekly Report shows inflows of $1.9 billion into digital asset investment products last week, marking the second consecutive week of strong buying activity. It isn’t surprising that Bitcoin and Ethereum dominated the inflows, but both XRP and Solana also turned out as standout performers in last week’s inflow numbers.

Heavy Accumulation Of XRP And Solana

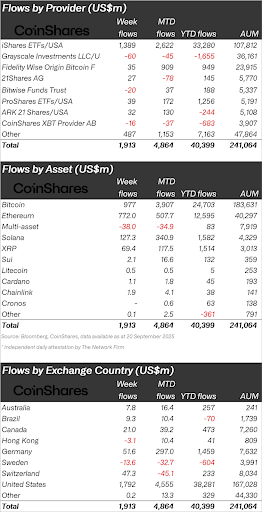

The broader digital asset market benefited from the Federal Reserve’s rate decision, with digital asset funds based on Bitcoin leading inflows at $977 million and Ethereum-based funds following with $772 million. This, alongside inflows into other altcoins, was enough to push last week’s total inflows into digital asset investment products $1.9 billion.

However, the most standout performer was Solana and XRP. These altcoins saw their digital asset funds recieve some of their highest weekly inflow rates on record.

Solana, which has grown to become one of the most sought-after altcoins by institutions, recorded inflows of $127.3 million last week. These inflows pushed Solana’s month-to-date figure to $340.9 million, while year-to-date inflows climbed to $1.58 billion. At Solana’s total assets under management (AUM) now stand at $4.33 billion.

The numbers also show that institutions are now treating XRP’s future not just with price speculations but as a cryptocurrency with strong adoption prospects. XRP-based investment products also posted a strong week with inflows of $69.4 million. This brought its month-to-date inflows to $117.5 million and lifted year-to-date inflows to $1.51 billion. Assets under management for XRP funds have also risen to $3.01 billion. The inflows into XRP are influenced by ongoing developments around Ripple’s payments network and rumors around a US-based Spot XRP ETF hitting the market soon.

Broader Inflow Trends And Regional Flows

The wider digital asset market benefited from the Federal Reserve’s decision to cut interest rates by 0.25 percentage points last week. Overall, total assets under management (AuM) for digital asset products reached $241.1 billion. Total assets under management (AuM) for digital asset investment products surged to $241.1 billion, the highest level so far in 2025.

Cumulative inflows this year have already hit $40.4 billion, which is a new year-to-date high. This puts the market well on pace to surpass last year’s $48.6 billion inflows into digital asset funds. Ethereum-based products also reached a very notable milestone of its total AuM at an all-time high of $40.3 billion.

Regionally, the United States dominated with $1.79 billion in inflows, while Germany ($51.6 million) and Switzerland ($47.3 million) also posted strong inflow figures. Notably, Sweden and Hong Kong saw outflows of $13.6 million and $3.1 million, respectively. Cardano, Chainlink, and Litecoin all posted inflows below $2 million each, while Sui-based products attracted $2.1 million.