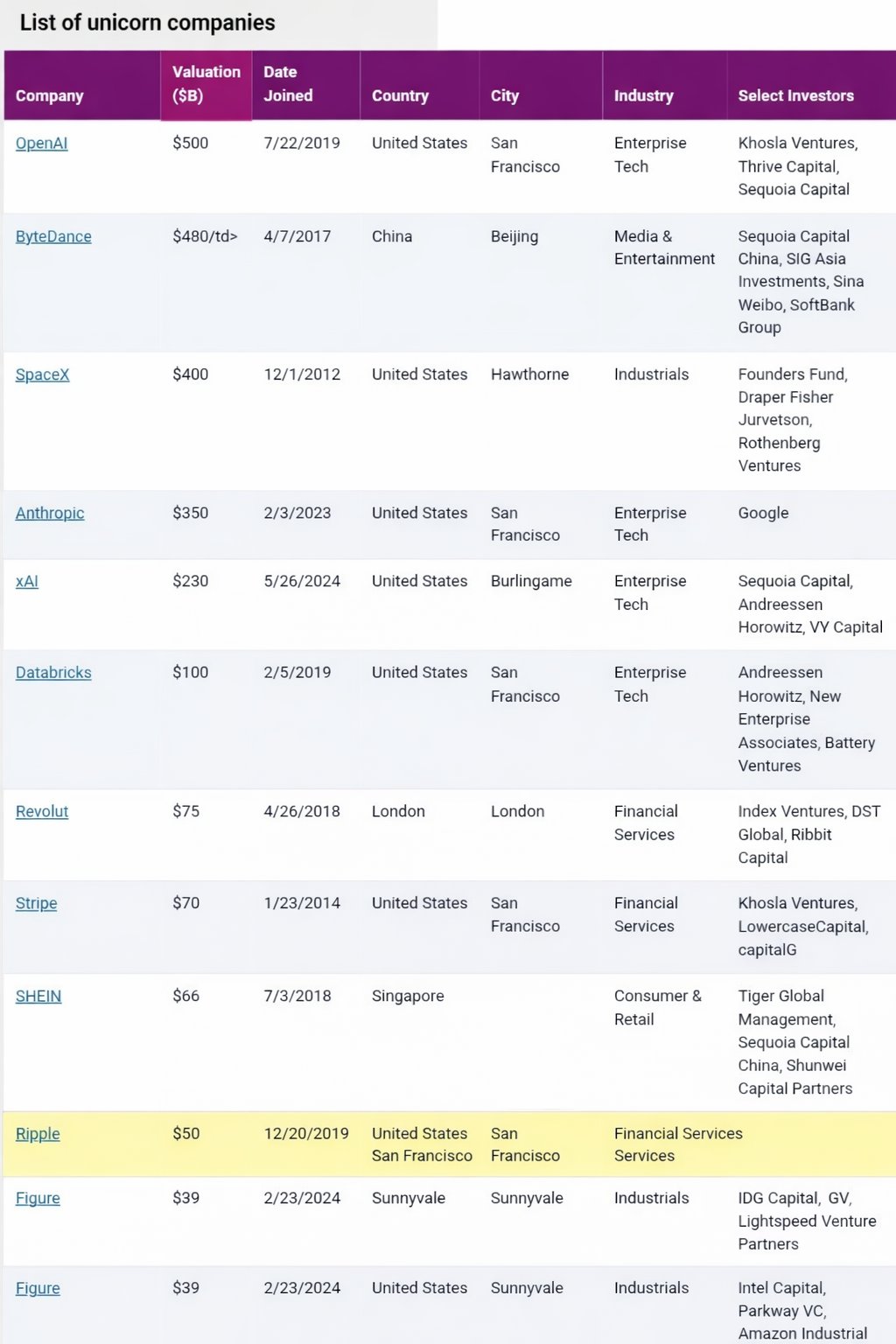

Ripple has been slotted into the global top 10 of the most valuable private companies at an estimated $50 billion valuation, according to a widely shared “unicorn companies” table circulating on X.

The ranking matters because it reframes Ripple less as a single-token narrative and more as a scaled private-market franchise: a payments infrastructure firm that, at least in secondary valuation terms, is now being discussed in the same breath as the largest AI and fintech “super-unicorns.”

Ripple Ranks #9 Among World’s Largest Private Companies

The image that has been widely reposted on X presents a “List of unicorn companies” with Ripple highlighted at a $50 billion valuation. In that snapshot, Ripple appears alongside a cohort dominated by AI, fintech, and consumer platforms, including OpenAI ($500B), ByteDance ($480B), SpaceX ($400B), Anthropic ($350B), xAI ($230B), Databricks ($100B), Revolut ($75B), Stripe ($70B), and Shein ($66B).

A $50 billion tag implies a step-up from a $40 billion post-money valuation associated with a late-2025 equity financing. Taking those two marks at face value, the move to $50 billion represents roughly a 25% increase in implied enterprise value in a short window, an unusually sharp change for a late-stage private company unless secondary markets are repricing aggressively or a new transaction has reset expectations.

Ripple’s private valuation history has also been shaped by company-led liquidity events. The firm has previously conducted share repurchases that effectively created valuation reference points for employees and early investors, including buybacks at an implied $15 billion valuation in 2022 and $11.3 billion in early 2024. Against that backdrop, the late-2025 jump to $40 billion and the current $50 billion figure depict a company whose private-market value has been re-marked upward in distinct steps rather than through the continuous feedback loop of public markets.

That context also matters for how traders and allocators interpret the headline. Private valuations are not the same thing as liquid market prices, and they can reflect transaction structure, preferred terms, or limited float dynamics as much as broad investor consensus. Still, when a company starts appearing on top-10 private-company lists dominated by AI and mega-fintech, it signals that the market increasingly views it as an infrastructure-scale business rather than a niche crypto-adjacent story.

The valuation narrative is also colliding with IPO expectations and Ripple’s consistent stance that a listing is not imminent. With no near-term plan or timeline to go public, Ripple’s price discovery remains anchored to episodic financings and tender offers, meaning the next meaningful datapoint could come from another private round, a new buyback, or secondary transactions that leak into the market.

For crypto markets, the immediate implication isn’t a direct token catalyst so much as a reframing of Ripple’s corporate footprint. If the $50 billion valuation is true, it sets a higher bar for how investors model the company’s optionality: whether that’s future capital raising, M&A capacity, or leverage in institutional partnerships. If it doesn’t, the episode will still have demonstrated how quickly private-market narratives can harden into “consensus” once a single, shareable number hits the timeline.

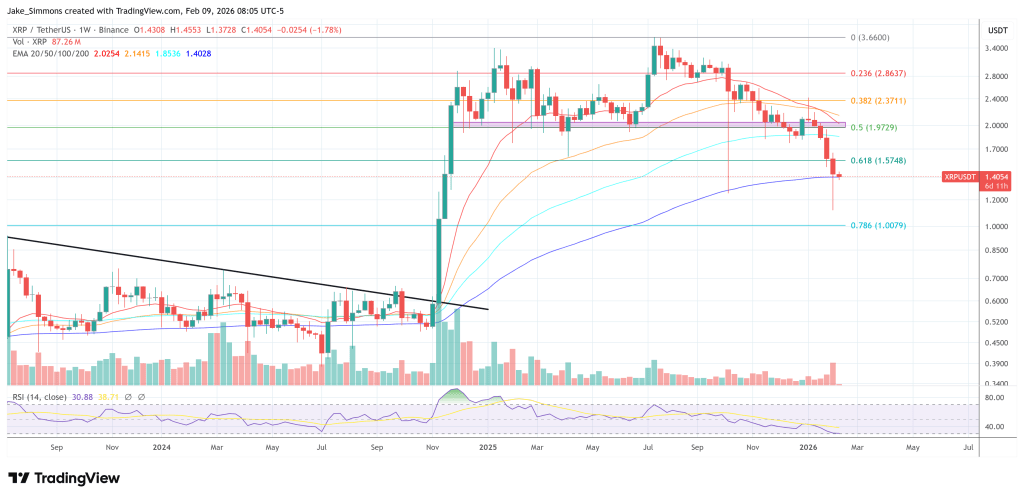

At press time, XRP traded at $1.40.