Galaxy Digital is warning that the Bitcoin selloff may not be finished, arguing that on-chain data, weakening technical levels, and a thin catalyst calendar leave BTC vulnerable to a deeper retracement toward the high-$50,000s over the coming weeks or months.

In a client note dated Feb. 1, 2026, Galaxy researcher Alex Thorn framed last week’s drawdown as more than a brief shakeout. Bitcoin fell 15% from Monday, Jan. 28 through Saturday, Jan. 31, with the move accelerating into the weekend. Saturday alone saw a 10% slide that, according to the note, triggered one of the largest liquidation events on record, wiping out more than $2 billion in long positions across futures venues.

Why The Next Weeks, Months Look Bearish For Bitcoin

The selloff pushed BTC as low as $75,644 on Coinbase and briefly drove the spot price below several widely watched investor cost bases. Thorn noted that BTC dipped as much as 10% beneath the average cost basis of US spot ETFs, estimated around $84,000 based on the prices at which creations occurred, before recovering some ground. At one point, BTC also pierced Strategy’s average cost basis of $76,037, and nearly revisited the 1-year low of $74,420 set during the April 2025 “Tariff Tantrum.”

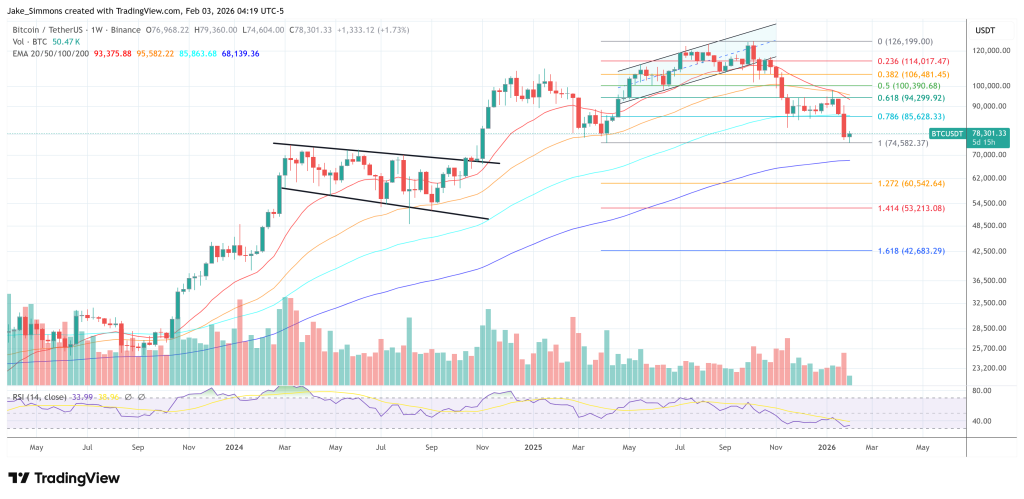

At the time of writing, Thorn pegged Bitcoin at roughly 38% below its Oct. 6, 2025 all-time high of $126,296. Historically, he argued, that magnitude matters: with the exception of 2017, the asset has not typically stopped at a 40% drawdown from peak without extending toward 50% within three months. A 50% decline from the October high would imply a move toward roughly $63,000.

Thorn’s central roadmap was defined by two long-term reference points that have repeatedly acted as “gravity” in prior cycles after key supports failed. Bitcoin lost its 50-week moving average in November 2025, and the note argued that, in previous bull markets, losing that level often preceded a deeper mean reversion to the 200-week moving average which currently sits around the $58,000 price mark.

Meanwhile, realized price, an on-chain proxy for the average cost basis of coins based on their last movement, is around $56,000. Both metrics rise over time if BTC trades above them.

The note pointed to ETF positioning as an additional stress test. US spot Bitcoin ETFs, launched in January 2024, had amassed $54 billion in net inflows as of the week ending Jan. 30, 2026, down from a peak of $62.2 billion in early October 2025. Thorn highlighted that the prior two weeks were the second- and third-worst for ETF flows, with combined outflows of $2.8 billion, even as ETF holders largely remained in place through the broader drawdown.

On-chain distribution data also suggested to Galaxy that the $82,000–$70,000 region could be lightly defended, increasing the odds of a downward probe. Thorn described a noticeable ownership “gap” in that band, and argued that price often seeks out zones where demand has previously been established, particularly after sharp deleveraging events.

Thorn also flagged a deteriorating narrative backdrop. “Catalysts remain hard to find. Narratives are working against Bitcoin. There’s little evidence of significant accumulation,” he wrote, adding that BTC’s recent failure to track gold and silver amid macro uncertainty has undercut the “debasement hedge” framing.

Even so, the note stopped short of calling a clean break into the $50,000s inevitable. Thorn emphasized that long-term holder profit-taking, described as exceptionally heavy in 2024 and 2025, has begun to abate, a condition that has historically coincided with late-stage selloffs.

For traders, Galaxy’s framing sets up a tactical question: whether the current ETF cost basis area near $84,000 can hold as a near-term anchor, or whether the supply gap below turns into a vacuum that pulls BTC toward the $70,000 handle. If that gives way, the more consequential test is whether realized price and the 200-week moving average in the high $50,000s again function as the kind of cycle-defined floor Galaxy believes long-term investors have historically treated as an entry zone.

At press time, Bitcoin traded at $78,301.