Bitcoin’s six-week collapse has erased over $40,000 from its price, yet—according to Jeff Park, CIO at ProCap BTC and Bitwise advisor—the more important story may lie not in spot markets but in volatility.

In his November 22 Substack post “Where Does Bitcoin Go From Here?”, Park argues that “market structure has flipped sharply negative,” citing ETF outflows, the Coinbase discount, structural selling, and liquidations of over-levered longs. But beneath that surface stress, he says, “something in the structure of Bitcoin’s volatility markets is stirring again—something that looks more like the old Bitcoin, not the new one.”

Sudden Twist In Bitcoin Skew Has Expert On High Alert

For nearly two years, the consensus has been that the ETF era “tamed Bitcoin” and “crushed volatility.” Spot ETFs channeled institutional flows into volatility-muting structures, dampening the wild swings that once defined BTC. Yet Park notes that over the last 60 days, implied volatility (IV) has trended higher for the first time in 2025. Even more telling: IV kept rising while spot fell—an uncommon dynamic since ETFs launched. That, he says, “might be the first signal of a regime shift” back toward pre-ETF market behavior.

Historical context sharpens his point. Between 2021 and 2022, IV spiked repeatedly—156% during China’s mining ban, 114% in the Luna/UST collapse, and again in the 3AC and FTX crises. Since FTX, volatility “has never traded above 80%,” and vol-of-vol (the “velocity” of volatility itself) has remained below 100, a post-ETF pattern of subdued convexity. But the latest upward drift, Park argues, suggests that the “convex, breakaway vol behavior” that once defined Bitcoin could be re-emerging.

That shift carries structural implications. During past crises, put skew widened sharply, reaching –25%. But Park highlights an opposite kind of stress test—January 2021—when call skew surged above +50% and triggered Bitcoin’s last “mega-gamma squeeze.” Dealers short call gamma were forced to buy spot into a rising market, pushing BTC from $20,000 to $40,000 in weeks. It was, he recalls, “the first time Deribit saw record retail flows as traders discovered the power of OTM calls.”

Today’s skew data looks different but potentially telling. “The 30-day put skew is the lowest it has been all year,” Park writes, suggesting defensive premiums are elevated and “further volatility to the downside is not unwarranted.” Yet Deribit’s open interest shows a market still leaning bullish in notional terms.

As of November 22, the largest positions include roughly $1 billion in Dec 26 $85k puts, $950 million in $140k calls, and $720 million in $200k calls—more upside than downside exposure overall. Similarly, the largest IBIT options are “more calls than puts, and the range of strikes are more OTM than the puts.”

Park’s broader thesis is that volatility itself may again become Bitcoin’s catalyst. He draws parallels to February–March 2024, when sustained ETF inflows and a steady vol bid preceded a dramatic melt-up. “Wall Street needs high volatility for Bitcoin to be interesting,” he writes, noting that institutional desks chase trend P&L into year-end, and “volatility is a reflexive machine.”

Whether that machine is restarting remains uncertain. Park concludes that if spot continues to fall while IV climbs, “the case strengthens that a sharp upside reversal could materialize.” But if vol stalls or slips as price declines—“classic sticky-delta behavior”—then the drawdown may harden into “the early contours of a potential bear trend.”

In essence, Park’s message is that Bitcoin’s most revealing signal isn’t price but structure. After two years of ETF-driven calm, volatility is moving again—and in Bitcoin’s history, when vol wakes up, price rarely stays still for long.

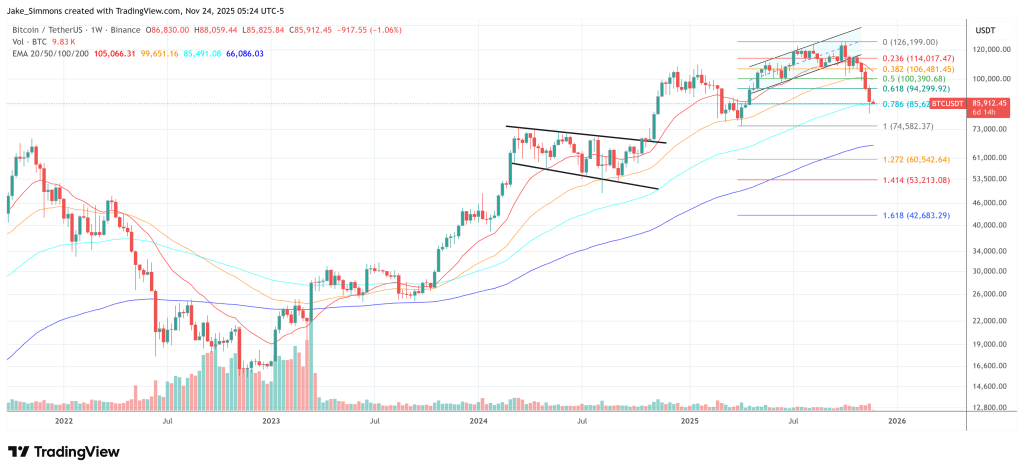

At press time, BTC traded at $85,912.