Bitcoin Magazine

Bitcoin Plunges Below $96K Support, Erasing 2025 Gains Amid Extreme Bearish Sentiment

Well, the hopes and dreams of the bulls have been dashed this week after Bitcoin closed the week out at $94.290, below the key $96,000 weekly support level. In the weeks ahead, we should expect more bearish price action as key support levels have been lost. Bounces back up may come, but they are unlikely to result in recapturing any meaningful price levels.

Key Support and Resistance Levels Now

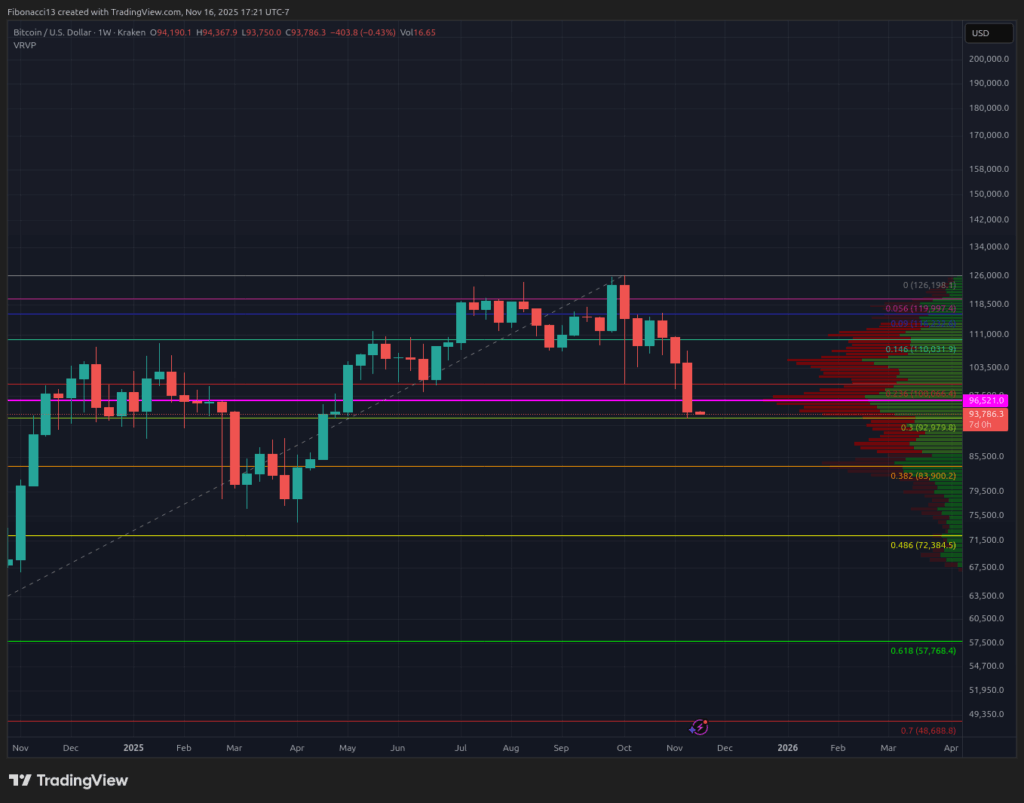

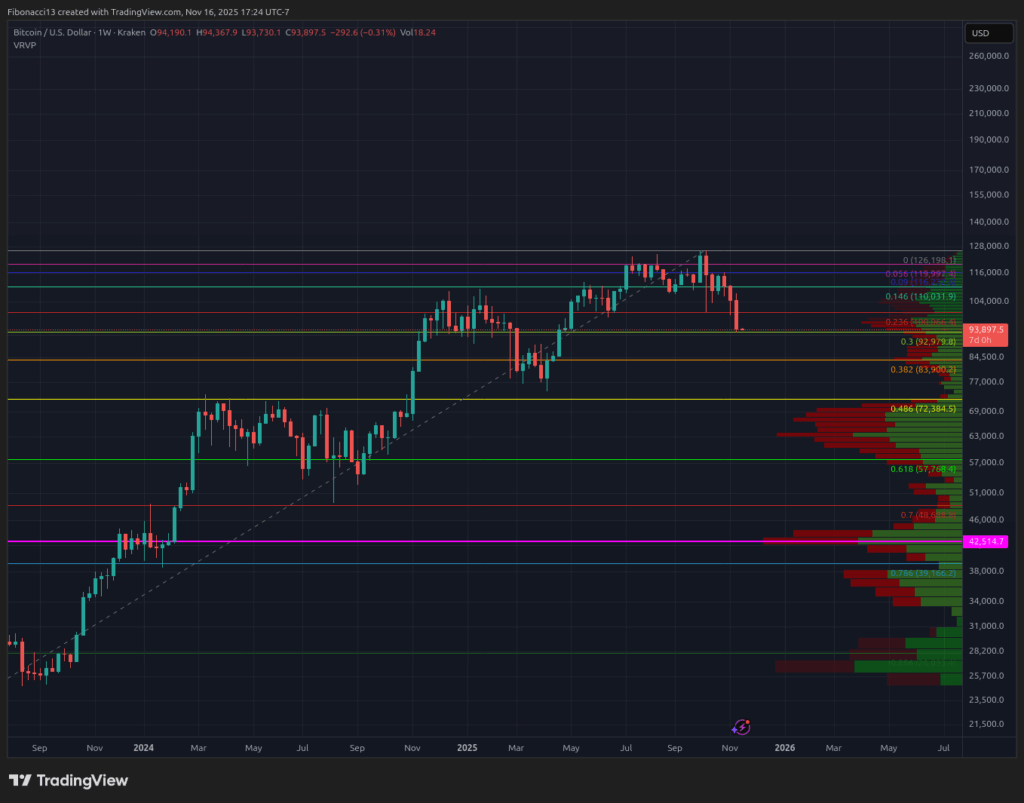

Bitcoin price closed below the $96,000 support level identified in this article in prior weeks. Closing near the lows below this level provides very little chance, if any, for the price to recover and resume a bull market anytime soon. Looking lower, we have our next major support level below at the 0.382 Fibonacci Retracement from the 2022 bottom to October 2025 high, and another high volume node sitting in the $83,000 to $84,000 area. Below here, we would look to the highs of the 2024 consolidation zone between $69,000 and $72,000.

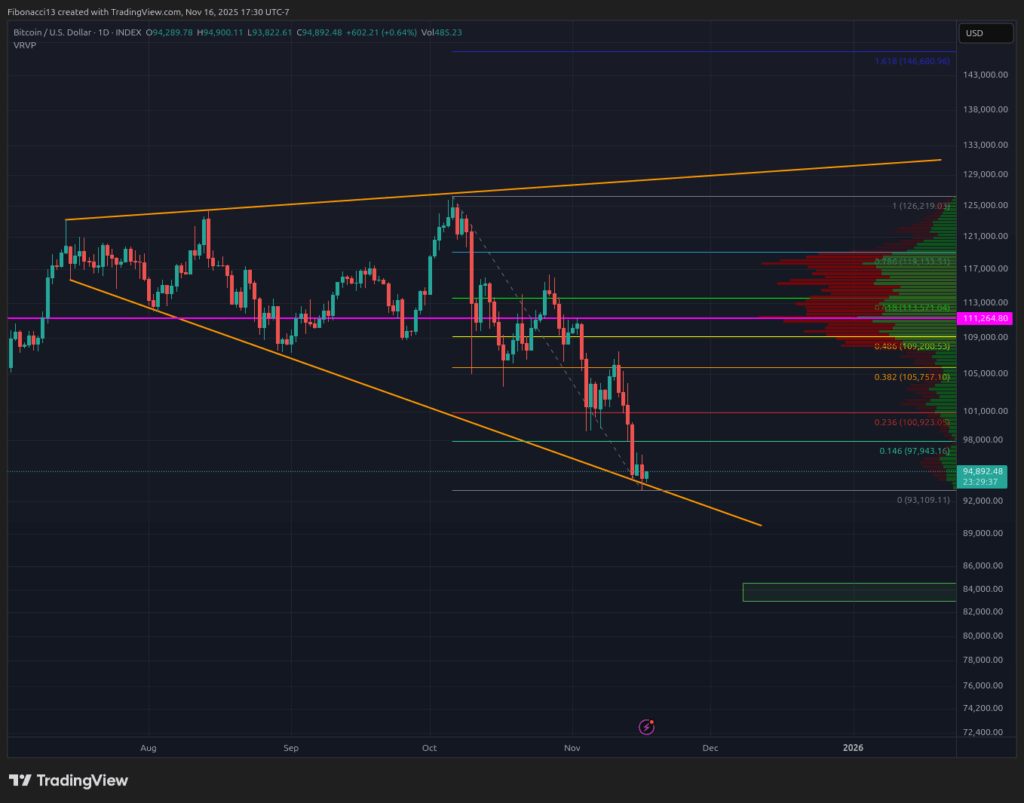

Resistance above $94,000 is thick now. With the price closing so low, we should not expect much of a bounce at this level, if any. If price does see any kind of bounce this week, we will look to the $98,000 level to hold as resistance. A short squeeze may be able to push the price past here to $101,000. Above this level, we have the equivalent of a brick wall in the $106,000 to $109,000 zone. Beyond the wall lies $114,000 as significant resistance, and $116,000 as a final reinforcement for the bears. If price closes above $116,000, if bulls can bash all the way up there, we would need to re-examine the market structure as it could flip bullish up there.

Outlook For This Week

Do you believe in miracles? You will need to know if you expect the bitcoin price to see any kind of meaningful rally this week. There is a tiny bit of hopium for the bulls in that the broadening wedge pattern has not definitively broken bearish. If we stretch it out as low as it can go (adjusted from prior weeks), the price is barely supported at the bottom at current lows. It’s a tall task for bulls, though, to make any meaningful gains with all the resistance levels outlined above. The best that bulls should expect is a bounce to $106,000, with the price likely to roll over to new lows from anywhere South of there. More likely, the broadening wedge will break to the downside at some point this week as bears are clearly in full control.

Market mood: Extremely Bearish – The bulls are down and out. Sitting at around $94,000, bitcoin has fallen over 25% from the October highs. Little hope remains for any meaningful rally or new highs after losing major support levels.

The next few weeks

Examining all angles of the 4-year bitcoin cycle theory, the high has most likely already taken place. Timing for this was expected to take place sometime between September and December 2025, but with the price so low and so much resistance overhead, it is highly unlikely any kind of rally will sustain enough strength to bring the price to new highs before the end of this year. Is the 4-year cycle over? Well, seemingly not, since the price made a high in early October and has essentially gone straight down from there. Could we see a late 4-year cycle high in Q1 2026? Well, sure, it’s possible, but still highly improbable given bitcoin’s lack of strength in recent weeks, while the stock market has remained strong. With the traditional stock market appearing to have a bearish outlook for the foreseeable future, it is unlikely that bitcoin will see any meaningful rally during this period as well.

Terminology Guide:

Bulls/Bullish: Buyers or investors expecting the price to go higher.

Bears/Bearish: Sellers or investors expecting the price to go lower.

Support or support level: A level at which the price should hold for the asset, at least initially. The more touches on support, the weaker it gets and the more likely it is to fail to hold the price.

Resistance or resistance level: Opposite of support. The level that is likely to reject the price, at least initially. The more touches at resistance, the weaker it gets and the more likely it is to fail to hold back the price.

Fibonacci Retracements and Extensions: Ratios based on what is known as the golden ratio, a universal ratio pertaining to growth and decay cycles in nature. The golden ratio is based on the constants Phi (1.618) and phi (0.618).

Volume Profile: An indicator that displays the total volume of buys and sells at specific price levels. The point of control (or POC) is a horizontal line on this indicator that shows us the price level at which the highest volume of transactions occurred.

Broadening Wedge: A chart pattern consisting of an upper trend line acting as resistance and a lower trend line acting as support. These trend lines must diverge away from each other in order to validate the pattern. This pattern is a result of expanding price volatility, typically resulting in higher highs and lower lows.

This post Bitcoin Plunges Below $96K Support, Erasing 2025 Gains Amid Extreme Bearish Sentiment first appeared on Bitcoin Magazine and is written by Ethan Greene – Feral Analysis and Juan Galt.