In a wide-ranging September interview with Bitcoin Magazine, MicroStrategy executive chairman Michael Saylor condensed five years of corporate experimentation into a stark, almost mechanical blueprint for what he calls Bitcoin’s “endgame”: accumulate an unprecedented stockpile of the asset as digital capital, then manufacture a new tier of credit markets on top of it.

“The endgame is we accumulate a trillion dollars worth of BTC and then we grow that capital by issuing more credit,” Saylor said. He cast the maneuver not as a speculative side bet but as the next logical phase of corporate finance, with Bitcoin reconstituted as “digital energy” and balance sheets reimagined as engines that spin yield from over-collateralized, Bitcoin-backed instruments.

Saylor’s Bitcoin Endgame Plan

Saylor’s framing is deliberately elemental. He stitched BTC into a centuries-long lineage of civilization-scale energy breakthroughs—from fire and steel to petroleum and electricity—arguing that the asset’s monetary properties are best understood as a way to move economic “energy” across time and space at light speed.

“Bitcoin is hope because Bitcoin represents digital energy,” he said. “A way to convey energy through time, through space… the next paradigm shift.” To Saylor, the institutional misunderstanding of that shift is not a bug but the core of the opportunity. “I would say 95% of the decision makers in the finance world still don’t really embrace or understand the idea of digital energy,” he argued, adding that society’s digestion lag is typical of paradigm shifts: “Bitcoin is evolving faster than society can digest it.”

At the heart of the playbook is a simple balance-sheet identity, scaled. Treat Bitcoin as the monetary base—“digital gold”—then securitize it as “digital credit” in forms familiar to capital markets: converts, preferreds, money-market-like paper, longer-duration bonds. “If I create a company that buys Bitcoin and I accumulate a billion dollars of Bitcoin, I have a billion dollars of digital capital. What can I do with it? I can issue digital credit,” he said.

In Saylor’s model, the equity of a firm that repeatedly performs this cycle becomes “digital equity,” engineered to outperform the underlying asset through conservative leverage and tenor management: “If I want to create a company that’s going to perform 2x Bitcoin, I take the Bitcoin, I issue Bitcoin-backed credit… I create digital equity and the digital equity outperforms the underlying capital asset.”

He insists the competitive set is not other Bitcoin treasuries but the vast inventory of 20th-century credit—mortgage, corporate, and sovereign—priced off low or repressed yields and often secured by depreciating or illiquid collateral. “What they’re competing against is the existing credit instruments in the capital market,” Saylor said.

The pitch to savers is equally blunt: the “better bank” is one that strips out duration and pays a spread over the fiat status quo, funded by over-collateralized Bitcoin. He sketched it in operational terms: raise equity, buy Bitcoin, then sell short-duration, BTC-secured credit “that just strips the duration to one month… and give people 500 basis points more yield than the risk-free rate in the capital market where you’re selling the credit.”

The scale he envisions is not modest. Saylor walked through jurisdictions where financial repression or chronically low policy rates amplify the spread, arguing that mature markets with suppressed yields are the ripest soil for “pure-play digital credit issuers.” Switzerland and Japan were his canonical examples.

The aspiration, however, is global. “What if there’s a hundred trillion dollars of digital credit and… 200 trillion worth of digital capital,” he asked, emphasizing that such a structure could remain over-collateralized rather than drift into fractional banking. He also pressed the geopolitical logic: corporate treasuries and well-capitalized exchanges, miners, and custodians become the “first line of economic defense,” lobbying and normalizing Bitcoin within domestic rule-sets the way incumbent industries do. “If you want to win the monetary war you need the institutions that control all the capital and… the support of the government,” he said.

Bitcoin Treasury Companies Will Be Banks

Saylor was explicit that corporate adoption is already compounding. He traced the cohort of publicly traded balance sheets holding BTC from a single firm in 2020—MicroStrategy—to “two or three… then 10… then 20… then 40… about a year ago there were 60… three months ago there were 120 and right now there’s more than 180,” with the target trajectory moving from “100 to a thousand to 10,000 to 100,000.” He blended that diffusion story with the platform thesis—Bitcoin built natively into iOS, Android, Windows, and consumer hardware—arguing that operating-system-level support is the other clear signal that “digital energy” has fused with the fabric of commerce.

Asked about the distributional critique—that corporations crowd out individuals—Saylor inverted the premise, claiming institutional flows have largely accrued to early holders. “When we got involved, Bitcoin was trading $9,000 a coin… today Bitcoin’s $115,000,” he said, attributing much of the appreciation to corporate and ETF demand. “That means that 93% of the gain… went to the individuals that owned the Bitcoin before the corporations got involved.”

The rhetoric can be martial—Saylor calls it a “protocol war”—but his operational discipline hinges on avoiding the traps that wrecked miners in the last cycle. Short and expensive liabilities layered onto depreciating hardware was, in his view, the fatal mismatch. The treasury archetype he champions favors mid-to-longer duration capital structures tied to an appreciating base asset. “If you take a mid-duration or long-duration loan and buy an asset appreciating 30 to 60% a year, you’ll probably be fine,” he said, dismissing M&A diversification as value-destructive opacity compared to the “perfect partner” of simply buying more BTC at “one times revenue.”

Saylor On US Policy

Saylor also pushed the policy and infrastructure horizon, predicting a phased legitimization of tokenized assets while stressing that the “greatest regulatory clarity” remains BTC’s status as a digital commodity that can sit on balance sheets and collateralize credit. He summarized the new political posture in Washington as supportive of making the US a “global Bitcoin superpower”—not by nationalizing miners or acquiring equity stakes, but by mainstreaming custody, collateralization, lending, operating-system integration, and tax treatment. “They want the finance companies in the United States to lead the way… and the finance companies in the United States to lead the way in digital assets and digital capital and Bitcoin adoption,” he said.

For a community accustomed to debating halvings, hash rate, or on-chain heuristics, Saylor’s endgame centers elsewhere: indexes, coupons, tenors, and yield curves—all re-denominated atop a new monetary base. It is a corporate finance thesis at Bitcoin’s core. And it doubles as a provocation to boards and CFOs in every currency regime: “For every company in the world in any capital market, they’re always better off to buy Bitcoin as their capital asset,” he said. The rest is execution at scale. “Get to a trillion dollars of collateral growing 30% a year, be issuing $100 billion of credit a year, growing 20, 30% a year,” Saylor concluded. “We’re building a better bank.”

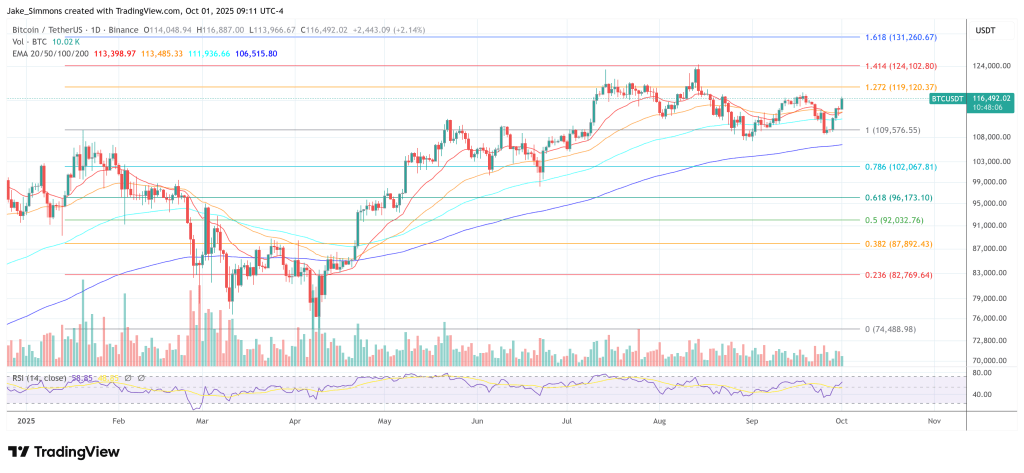

At press time, Bitcoin traded at $116,492.