Bitcoin Magazine

Fed Rate Cut Boosts Bitcoin Price Ahead of Q4 Melt-Up

Historically, bitcoin’s price peaks approximately 20 months after a Bitcoin halving. The last Bitcoin halving occurred in April 2024, which means we could see a cycle top by December of this year.

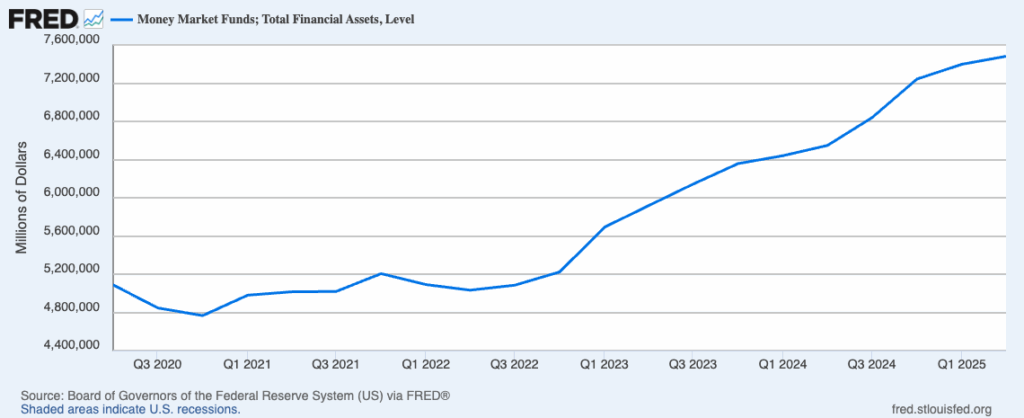

The odds of this are increasingly likely as Fed Chair Powell cut rates by 25 bps today, giving the approximately $7.4 trillion sitting in money market funds a reason to come off the sidelines and move into a hard asset like bitcoin, especially now that it’s easier to obtain exposure to bitcoin via spot bitcoin ETFs and proxies like bitcoin treasury companies.

Powell also signaled today that two more rate cuts could be on the way before the year is out, which would only further reduce returns in money market funds, potentially pushing investors into hard assets like bitcoin and gold as well as riskier assets like tech and AI-related stocks.

This could catalyze the final leg of a “melt-up” comparable to what we saw with tech stocks at the end of 1999 before the dot com bubble burst.

Also, much like the likes of Henrik Zeberg and David Hunter, I believe the stage is being set for the final parabolic leg of a bull run that began in late 2022.

Using a traditional financial index as a reference point, Zeberg sees the S&P 500 exceeding 7,000 before the year is out, while Hunter sees it rising to 8,000 (or higher) within the same time frame.

What is more, we may be witnessing the breakdown of a 14-year support level for the US dollar, according to Macro Strategist Octavio (Tavi) Costa, which means we could see a markedly weaker dollar in the coming months, something else that would support the bull case for hard and risk assets.

What Happens Come 2026?

Both Zeberg and Hunter believe that, as of early next year, we’ll see the largest bust across all markets that we’ve seen since October 1929, when financial markets in the US collapsed, spurring the onset of the Great Depression.

Zeberg’s rationale for this includes the real economy grinding to a halt, in part evidenced by the amount of homes on the market.

Hunter believes that we’re at the end of a half century long secular debt-fueled cycle that will end with a leverage unwind unlike anything we’ve seen in modern history, as per what he shared on Coin Stories.

Other signals like loan payment delinquencies also point to the idea that the real economy is screeching to a halt, which will inevitably have an effect on the financial economy.

The Bitcoin Downturn Isn’t Guaranteed, but It’s Likely

Even if we aren’t headed towards a global macro bust, bitcoin’s price will take a hit in 2026 if history repeats itself.

That is, bitcoin’s price dropped from almost $69,000 at the end of 2021 to approximately $15,500 by the end of 2022 and from almost $20,000 at the end of 2017 to just over $3,000 at the end of 2018.

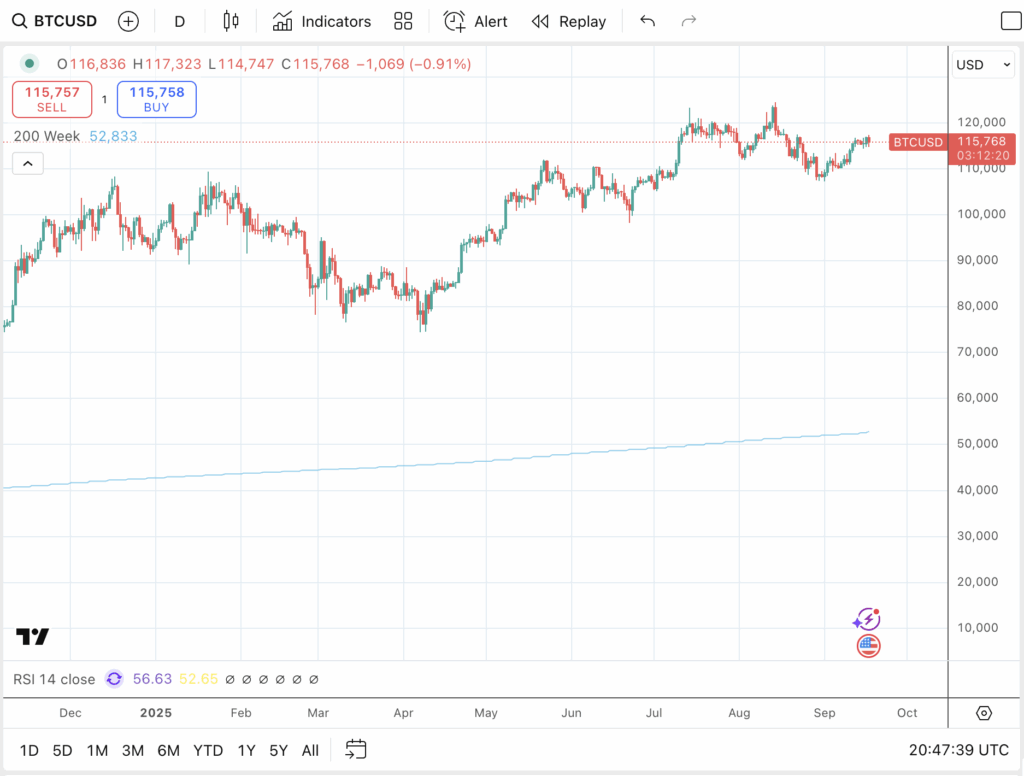

In both cases, bitcoin’s price either tapped or dipped below its 200 Week Standard Moving Average (SMA), the light blue line on the charts below.

Currently, bitcoin’s 200 Week SMA is sitting at about $52,000. If we see a parabolic rise in bitcoin’s price in the coming months, it could rise as high as $65,000, before bitcoin’s price drops to such a price point or lower some time in 2026.

If we do see the type of bust that Zeberg and Hunter are forecasting, bitcoin’s price could also drop well below that threshold.

With all of that said, no one knows what the future holds, and please don’t interpret anything in this article as financial advice.

At the same time, you may want to keep in mind that while history doesn’t necessarily repeat itself, it often rhymes.

This post Fed Rate Cut Boosts Bitcoin Price Ahead of Q4 Melt-Up first appeared on Bitcoin Magazine and is written by Frank Corva.