Ethereum is trading around the $1,600 level after several days of failed attempts to reclaim higher prices. Bulls are showing signs of life, but their momentum remains weak as bearish pressure continues to dominate the market. Despite a brief recovery bounce last week, Ethereum’s broader structure still reflects a clear downtrend.

The crypto market remains under the shadow of macroeconomic uncertainty, as ongoing tensions between the United States and China weigh heavily on global financial sentiment. No resolution or agreement between the two economic giants has been announced, leaving investors cautious and risk-averse.

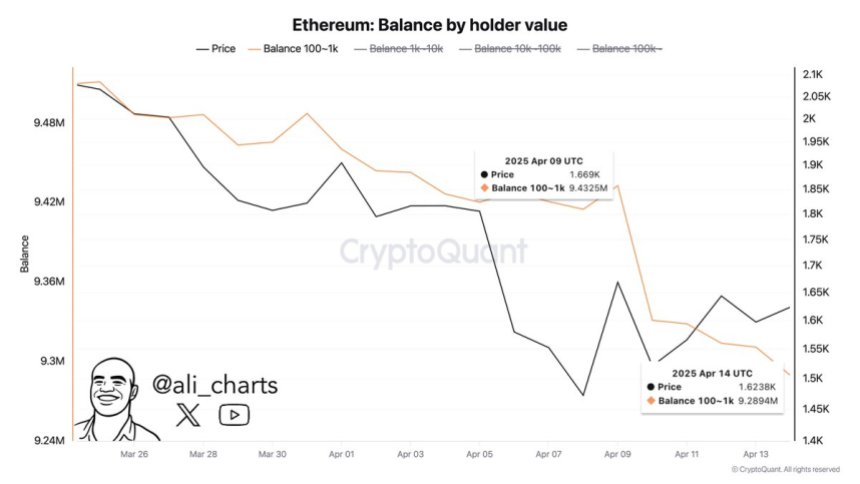

Adding to the negative sentiment, CryptoQuant data shows that Ethereum whales have offloaded approximately 143,000 ETH over the past week. This large-scale distribution reinforces fears of further downside, with long-term holders and large wallets choosing to reduce exposure rather than accumulate.

While some analysts still see potential for a turnaround if key levels are reclaimed, the current market environment remains fragile. Unless Ethereum can regain and hold above short-term resistance levels, the threat of another leg down remains very real. Traders are now closely watching price action for signs of a shift — but for now, caution continues to lead the way.

Ethereum Faces Selling Pressure As Whales Exit

Ethereum is facing a critical test as price action continues to lack clarity, and support levels remain fragile. Despite brief attempts to rebound, ETH has failed to establish a clear bottom, and the downtrend structure remains intact. The market is struggling to define a strong demand zone, making it difficult for bulls to sustain upward momentum. As selling pressure mounts, analysts are warning that Ethereum may continue to slide toward lower demand levels in the absence of strong buying interest.

Broader macroeconomic conditions continue to weigh heavily on risk assets like Ethereum. Global trade tensions, particularly the unresolved tariff standoff between the United States and China, have created uncertainty across financial markets. Combined with fears of a slowing global economy and lack of coordinated fiscal support, crypto markets remain under pressure.

Adding to the bearish sentiment, top analyst Ali Martinez shared on-chain data revealing that whales have offloaded approximately 143,000 ETH over the past week. This large-scale distribution by influential holders has significantly weakened Ethereum’s outlook, reinforcing concerns that smart money is preparing for deeper downside.

Since late December, ETH has remained in a prolonged bearish trend, with every attempt at recovery being met by renewed selling. Unless bulls reclaim key technical levels and shift market sentiment, Ethereum may continue to slide further.

ETH Price Stuck In Volatile Range

Ethereum is currently trading at $1,600 after enduring days of massive volatility and macroeconomic-driven uncertainty. Despite brief relief bounces, ETH remains locked in a bearish structure, unable to generate sustained momentum. For bulls to regain control, reclaiming the $1,850 resistance level is critical. This level aligns with the 4-hour 200 MA and EMA around $1,800, making it a key zone to watch for confirmation of a short-term trend reversal.

Holding above these moving averages would signal renewed strength and possibly mark the beginning of a recovery rally. However, price action continues to struggle beneath them, and failure to push above these indicators would confirm persistent weakness. In that case, Ethereum may retest the $1,500 level or even dip below it if selling pressure intensifies.

The current environment is shaped by global tensions and macro uncertainty, with no clear catalysts to drive a breakout in either direction. As long as ETH remains below its key moving averages, the risk of another leg down remains elevated. Bulls must act swiftly to flip sentiment and avoid a deeper correction toward long-term demand levels.

Featured image from Dall-E, chart from TradingView