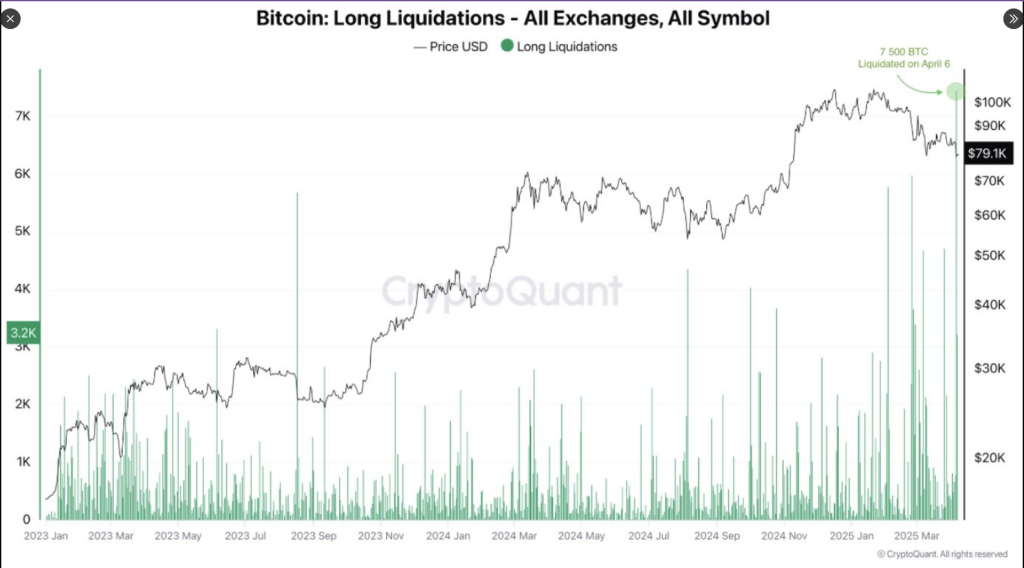

Bitcoin investors recorded heavy losses this week following the largest long position liquidation in the current bull market. On April 6, more than 7,500 BTC with a value exceeding $500 million were erased across prominent trading exchanges as prices dropped from $83,000 to $74,000.

Record-Breaking Liquidation Event Hits Crypto Market

As CryptoQuant analyst Darkfost noted, this liquidation was the highest of all since the 2023 bull rally began. The forced selling was prompted by Bitcoin’s price dropping sharply on spot markets before stabilizing around the $78,000 level after the initial collapse. Recovery since then has been negligible with prices remaining around that level.

The statistics indicate that although similar liquidations have occurred previously over the last two years, none were of Monday’s magnitude. This rapid market shift took most traders by surprise, particularly those who had opted to leverage their potential gains.

The biggest Bitcoin long liquidation event of this bull cycle

“On April 6, approximately 7,500 Bitcoin in long positions were liquidated, marking the biggest single-day long wipeout of the entire bull run so far.” – By @Darkfost_Coc

Read more

https://t.co/eqW2JE8TWD pic.twitter.com/IEthwRDRVz

— CryptoQuant.com (@cryptoquant_com) April 9, 2025

Trump Economic Policies Linked To Market Volatility

Darkfost refers to increasing fears regarding US President Donald Trump’s economic policy as a main driver of the market volatility. His plans to enforce tariffs have generated broader financial uncertainty that spreads beyond cryptocurrency markets.

Reports show the American stock market has suffered multi-trillion-dollar losses for a few consecutive trading days this month. A report said US stocks lost $10 trillion in value just three months since Trump became president in January 2025.

Experts Warn Traders About Risk Management

The prevailing market conditions have seen analysts issue warnings regarding the risks of trading during times of volatility. Darkfost highlighted the need to safeguard capital when markets are volatile, urging traders to steer clear of high-risk or leveraged positions.

For crypto investors, the message is one of caution rather than aggressive trading tactics. The swift price action illustrates how rapidly market conditions can shift, leaving unsuspecting traders with huge losses.

Long-Term Bitcoin Prognosis Is Still Mixed

Certain market observers foresee bearish patterns may be around for as long as 12 months because of continued global economic uncertainty. Ki Young Ju, the founder of CryptoQuant, observed that under uncertain conditions, more conventional safe-haven resources such as gold are better than cryptocurrency.

Ju noted that since Trump’s return to the presidency, gold has risen 11% in value while Bitcoin has fallen 25%. He contends this trend indicates Bitcoin hasn’t yet reached the status of true “digital gold” as a safe store of value.

In spite of these near-term worries, Ju is bullish on Bitcoin’s long-term prospects. He was confident that eventually, Bitcoin will gain a share of gold’s $20 trillion market cap, implying potential for long-term growth in spite of recent adversity.

At the time of writing, Bitcoin was able to reclaim the $81k level. BTC was up 7% in the last 24 hours, but sustained a 2% drop in the last week.

Featured image from Gemini Imagen, chart from TradingView