Bitcoin’s recent price action has put significant stress on a particular group of investors. Long-term holders are looking relatively okay with Bitcoin’s recent price action, short-term participants, on the other hand, are starting to feel the heat. Market data now suggests that this cohort may be nearing a point of capitulation, but the bigger picture reveals a more complex story where short-term holders can still hang on.

Short-Term Holders Face Losses But Stay Within Limits

On-chain data shows that Bitcoin’s short-term holders (STHs) have incurred realized losses of $7 billion over the past 30 days. Short-term holders are addresses who have held BTC for less than 155 days. This trend is noted through data from on-chain analytics platform Glassnode, which pointed out that the run of losses marks the most prolonged loss event of the current market cycle.

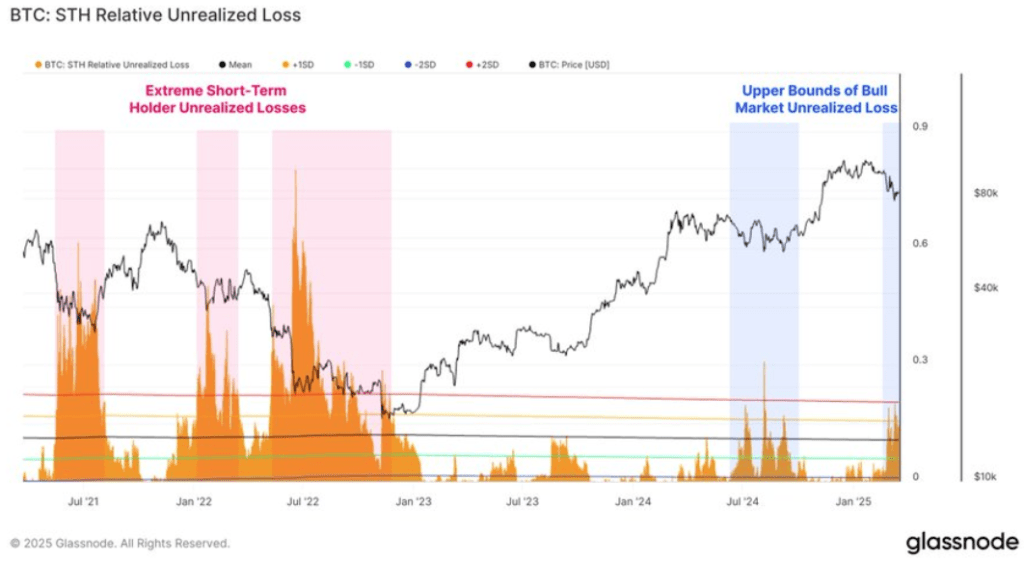

In addition to realized losses, unrealized losses have intensified, pushing many STH-held coins underwater. Glassnode’s analysis indicates that these losses are nearing the +2σ threshold, which is a level that has historically pointed to an increased risk of capitulation.

Image From X: Glassnode

Despite the mounting capitulation risk, history shows that short-term Bitcoin holders are not in the worst position they could be in. The current figures remain well below the $19.8 billion and $20.7 billion loss spikes witnessed during the 2021–2022 crash.

Image From X: Glassnode

Although the losses are significant, they are still aligned with patterns seen in the middle of previous corrections during bull markets. This relates to a technical outlook from crypto analyst PlanB that Bitcoin is still in the middle of its bullish run.

Bitcoin Bull Score Plunges, ETF Outflows Pressure Sentiment

Although Bitcoin might still be mid-cycle, sentiment indicators paint a pressured picture, with the price down by 23% from its recent all-time high in January. Data from CryptoQuant reveals that Bitcoin’s Bull Score has dropped to 20, its lowest point in two years. Major price recoveries have only taken place when the Bull Score climbs above 60. This current low reading is a sign that the crypto market is still trapped in uncertainty, where sellers are currently outpacing buyers and momentum.

Image From X: CryptoQuant

A contributing factor has been the sustained capital outflow from Bitcoin exchange-traded funds. Since February, more than $4.4 billion has flowed out of spot Bitcoin ETFs. These outflows have added weight to an already fragile price structure after Bitcoin started correcting from its all-time high in January.

As such, short-term holders who entered close to this high and were banking on a continued upside have been exposed to most of the losses.

Image From X: Ali_Charts

Despite the heavy outflows that defined the past few weeks, there are early signs that this trend may be turning. Data from SosoValue shows that Spot ETF behavior shifted last week, with consecutive days of net inflows into spot Bitcoin ETFs.

Image From SoSoValue

Particularly, Spot Bitcoin ETFs ended the week on a $744.35 million net inflow, bringing an end to five consecutive weeks of outflows. This return of institutional interest could be the first sign of stabilizing positive Bitcoin sentiment.

At the time of writing, Bitcoin was trading at $84,815.

Featured image from Pexels, chart from TradingView