Bitcoin is currently navigating a volatile phase, consolidating below the $100,000 mark after failing to hold it as a key support level. This recent setback has sparked uncertainty among investors, but the future still looks promising.

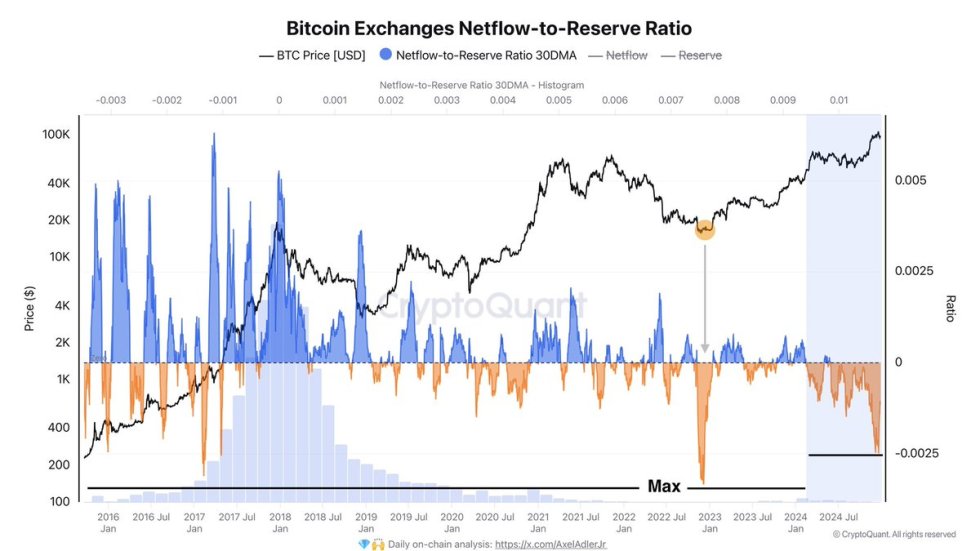

Despite the short-term turbulence, key metrics are painting a bullish picture of Bitcoin’s long-term prospects. A notable analysis by analyst Axel Adler highlights the Bitcoin Exchanges netflow-to-reserve ratio, a new metric shedding light on an ongoing accumulation phase in the market. This indicator shows that BTC is being moved from exchanges into long-term storage, signaling investor confidence and a potential price rally as the market matures.

While Bitcoin may be experiencing a temporary correction, the underlying fundamentals suggest a positive outlook for the digital asset in the future. With strong accumulation signals and growing institutional interest, BTC appears poised to regain momentum and continue its upward trajectory in the coming months.

Bitcoin Accumulation Taking Place

Axel Adler’s recent analysis of Bitcoin’s Exchange’s netflow-to-reserve ratio offers a fresh perspective on the ongoing accumulation phase within the market. The metric, which tracks the flow of BTC between exchanges and wallets, has proven to be a valuable tool in identifying investor sentiment.

A negative value in this ratio indicates that more Bitcoin is being withdrawn from exchanges than deposited, signaling that users are holding their BTC in private wallets rather than actively trading. This reduces the available supply on exchanges and often precedes upward price movements, as it suggests that investors are positioning themselves for long-term gains rather than short-term speculation.

The metric reached a notable peak at the end of the 2022 bear market, during a period of heightened fear and uncertainty. As the price of Bitcoin plummeted to around $17,000, a cohort of savvy investors—whom Adler refers to as “real smart players”—took advantage of the panic selling. These investors recognized the value of acquiring BTC at a discounted price and swiftly moved coins from exchanges to secure long-term holdings. This accumulation phase marked the bottom of the bear market, setting the stage for the bull market that would follow.

Looking at the current market conditions, the netflow-to-reserve ratio indicates a similar trend. Despite the recent volatility and the struggle to hold the $100,000 mark, the ongoing withdrawals from exchanges show that investors are once again accumulating Bitcoin. With the reserve steadily decreasing, the stage is being set for potential upward momentum as these holdings are likely to remain off the market for the long term, supporting the case for a bullish outlook in the years to come.

Holding Key Demand Levels

Bitcoin is currently trading at $94,800, holding strong after bears failed to push the price below the critical $92K support level. This resilience signals that buyers are stepping in, preventing a deeper decline and keeping BTC above this important threshold.

Now, the focus shifts to the bulls, who need to reclaim momentum and drive Bitcoin past the psychological $100K mark. Successfully breaking this level would not only confirm the strength of the current rally but also open the door for further gains.

However, if the price fails to break above $100K and struggles to maintain upward momentum, a retrace could be on the horizon. A deeper correction is also possible if BTC is unable to hold above key support levels. The most crucial demand zone to watch in case of a price decline would be around $90K.

This level has historically acted as a strong area of interest, where buying pressure could emerge and prevent a more significant pullback. If Bitcoin fails to hold $90K, it could open the door for a more substantial correction, putting the broader market into a period of consolidation. Traders will need to closely monitor price action near these levels to gauge whether Bitcoin’s bullish trend can resume or if a deeper correction is in store.

Featured image from Dall-E, chart from TradingView