The Income Tax Appellate Tribunal (ITAT) in Jodhpur, India, has today clarified the taxation of crypto transactions conducted before the financial year (FY) 2022-2023. According to the ruling, profits from all such transactions will be treated as capital gains.

ITAT Gives Clarity On Pre-2022 Crypto Taxation

In what is considered a landmark ruling for India’s digital assets ecosystem, the ITAT declared that cryptocurrencies like Bitcoin (BTC), Ethereum (ETH), and others, were capital assets before April 1, 2022. Consequently, any profits earned from their sale during that period should be categorized as capital gains rather than income from other sources.

For the uninitiated, India’s current virtual assets taxation framework came into effect on April 1, 2022, as part of Virtual Digital Assets (VDA) regulations. These rules impose a flat 30% tax rate on all crypto gains without allowing taxpayers to offset losses against gains. Additionally, a 1% tax deductible at source (TDS) is levied on every crypto transaction.

However, ITAT’s decision offers some relief to early Indian cryptocurrency adopters, as they will be subject to a lower tax rate than the flat 30% rate imposed under the current framework. Specifically, before April 1, 2022, short-term capital gains were taxed at 15%, while long-term capital gains were taxed at 10%.

The ITAT’s decision came while hearing a case involving an individual who had purchased BTC worth $6,478 in FY 2015-16 and sold it for $78,803 in FY 2020-21. The individual argued that the proceeds from the sale should be taxed as long-term capital gains since the asset was held for more than three years. However, the assessing tax officer disagreed, contending that digital assets assets, lacking intrinsic value, could not be classified as property.

In contrast, the ITAT dismissed the tax officer’s argument, stating that under Section 2(14) of the Income Tax Act, cryptocurrency qualifies as property. The tribunal clarified that “property of any kind held by an assessee,” including a right or claim over an asset, satisfies the definition of a capital asset.

India’s Regulatory Gap In Digital Assets

Despite boasting the highest crypto adoption rate globally, India continues to lag in creating a supportive regulatory framework for digital assets. As a result, numerous virtual assets businesses have relocated their headquarters to more crypto-friendly jurisdictions such as the UAE or Singapore.

India’s high tax regime – 30% on gains and 1% TDS on transactions – has been a frequent target of criticism. Last year, the former CEO of WazirX digital assets exchange predicted that the current tax structure would remain in place for at least two more years before any significant revisions.

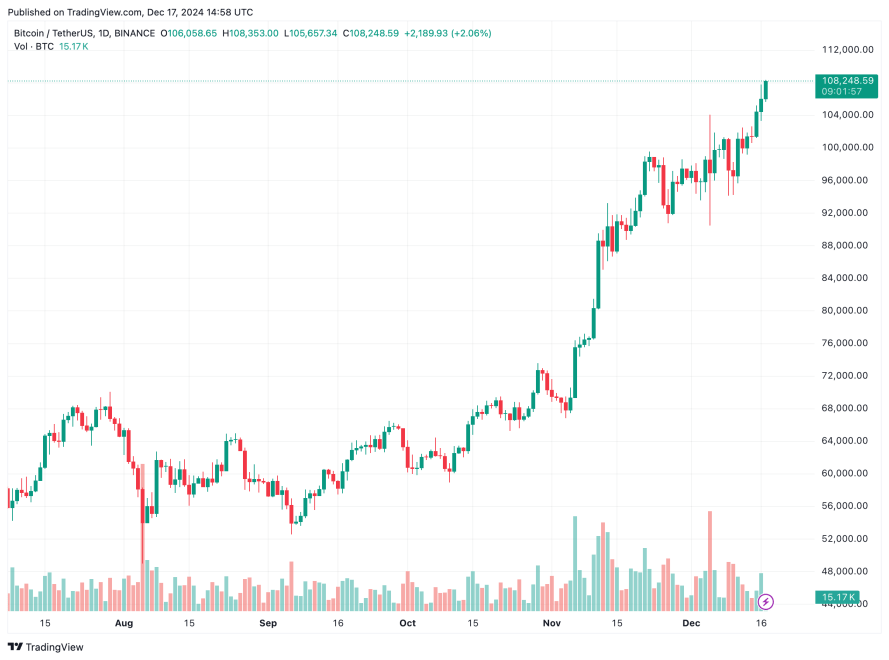

The Indian government is considering consultations with industry experts to shape a balanced regulatory framework for cryptocurrencies. BTC is trading at $108,248 at press time, up 2.5% in the past 24 hours.