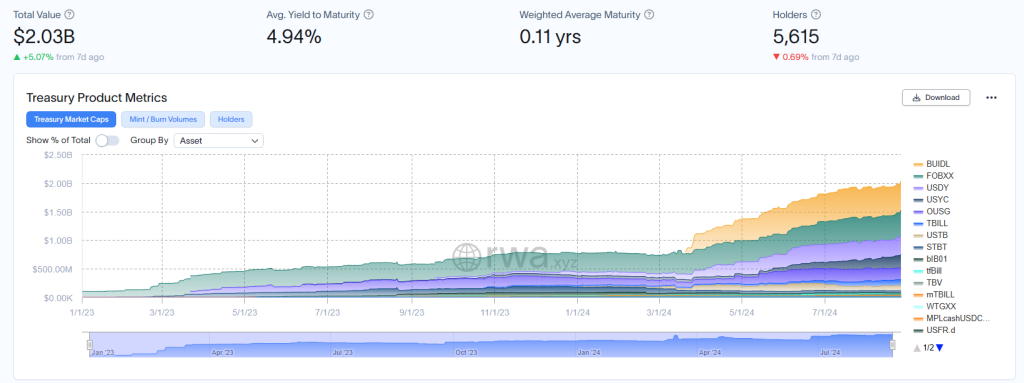

The tokenized treasuries market finally assembled a $2 billion market capitalization, which took precisely 151 days instead of 452 days. Heavy institutional investments are at the root of this remarkable growth, with the biggest players being none other than BlackRock.

Growth Fueled By Institutional Powerhouses

All of this is changing, though, with the launch of BlackRock’s USD Institutional Digital Liquidity Fund (BUIDL), which has quickly reached a $503 million market cap—nearly obliterating the rest of the tokenized treasury space.

In four months, it grew to a market cap of around $503 million, the single largest fund under the tokenized treasuries space. With the success this fund has had, it gives some level of confidence to investors; hence, it actually attracted more investor interest in tokenized treasuries.

Among other well-known funds growing less impressively are Franklin Templeton’s OnChain US Government Money Fund, FOBXX, and the US Dollar Yield from Ondo Finance, USDY. Each of these has grown, too, but from lower bases of $425 million and $364 million, respectively.

This rise in the value of institutional money has not only driven up the market cap but given immense credibility to tokenized treasuries. Now, investors are more willing to dive into this innovative financial product, where the traditional world of government securities gains from the benefits brought about by blockchain technology.

The Appeal Of Tokenized Treasuries

Tokenized treasuries offer seamless trading on public blockchains like Ethereum and Solana by digitizing US Treasury assets. This technical breakthrough simplifies it and opens up the US Treasury market to more investors, including foreigners. It has transformed securities into digital tokens, lowering market entry barriers.

One of the biggest benefits that tokenization brings is liquidity. In fact, it is a simple exercise for investors who want to redeem their monies, considering that tokenized securities and assets are traded 24/7—an absolute opposite of the traditional markets. One can also redeem his or her tokens for stablecoins through the use of smart contracts, which makes it easy for the investor to access cash without the long processes typical of traditional finance.

Tokenized treasury analysts predict a bright upshot. Apparently, some forecast that the market may extend to slightly over $3 billion by year-end, since the number of DeFi projects and DAOs showing interest in the asset class continues to rise. In particular, such companies find tokenized treasuries very useful for inclusion in their portfolios, as it will allow them stable and risk-free yields.

But the market has to face headwinds. Macroeconomic factors, like changes in interest rates, could also be very bearish for investor sentiment. If the rise in rates is too big, the allure of such tokenized assets might very easily go away. Added to that would be the regulatory hurdles, given that the integration of traditional finance with blockchain technology is still to a large extent uncharted waters.

Featured image from Conduit Financial, chart from TradingView