In a recent filing with the US Securities and Exchange Commission (SEC), the BlackRock Global Allocation Fund disclosed its ownership of 43,000 shares of the asset manager’s Bitcoin ETF, iShares Bitcoin Trust, as of April 30.

This announcement follows two previous filings by BlackRock on May 28, which disclosed the fund’s exposure to Bitcoin in its Strategic Global Bond Fund and Strategic Income Opportunities Portfolio.

BlackRock Bitcoin ETF Investment Plan

The investment giant’s move towards Bitcoin integration became evident in March when it submitted a filing to the SEC, expressing its intention to include Bitcoin ETFs in its Global Allocation Fund.

BlackRock’s objective is to invest in Bitcoin ETFs that directly hold BTC, aiming to mirror the performance of the digital currency market.

The company’s filing specified that the Global Allocation Fund may acquire shares in exchange-traded products (ETPs) that seek to reflect the price of Bitcoin by directly holding the cryptocurrency. However, it clarified that investments in Bitcoin ETPs will be limited to those listed and traded on recognized national securities exchanges.

This initiative aligns with BlackRock’s broader investment strategy for its Global Allocation Fund, a mutual fund designed to diversify investors through a wide range of assets, including equities, bonds, and potentially Bitcoin ETPs.

With $17.8 billion in assets under management (AUM) and a year-to-date return of 4.61% as of March 2024, the fund aims to capitalize on global investment opportunities while effectively managing risk and pursuing long-term capital growth and income.

This marks the third internal BlackRock fund to invest in Bitcoin through the iShares Bitcoin Trust (IBIT) ETF. The Strategic Global Bond Fund, Strategic Income Opportunities Portfolio, and now the Global Allocation Fund have all recognized the potential of Bitcoin as an investment asset.

Bitcoin Price Analysis

In the past 24 hours, Bitcoin has shown resilience by reclaiming the $61,780 level after experiencing a dip to as low as $58,000 on Monday. This recovery suggests that the leading cryptocurrency is withstanding the selling pressure it has encountered over the past week, indicating a potential continuation of its halted uptrend.

According to technical analyst Ali Martinez, Bitcoin is forming an Adam & Eve bottoming pattern, which could lead to a projected 6% increase towards $66,000 if BTC maintains a candlestick close above the $62,200 level.

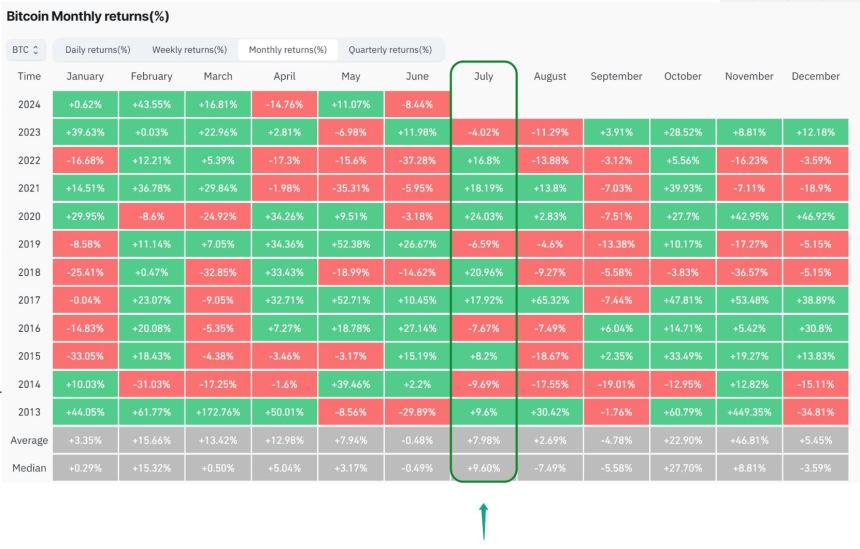

Furthermore, historical data indicates that July has historically been favorable for Bitcoin’s price growth, particularly in years of Halving.

Analyzing the image above, 7 out of the previous 11 July months resulted in positive gains. The green months, in particular, generated an impressive upside of 16.52%, while the red months experienced a downside of 6.99%.

Examining the performance of Bitcoin in the third quarter (Q3), the data presents a more balanced picture. Out of the previous 11 Q3 periods, 5 were positive. Green Q3s, on average, produced a significant upside of 33.52%, while red Q3s generated an average downside of 16.023%.

Whether historical price performance will repeat itself, leading to price gains for BTC, remains to be answered. If history were to repeat in this scenario, it could potentially result in Bitcoin retesting its all-time high, which reached $73,700 in March, potentially even surpassing it.

Featured image from DALL-E, chart from TradingView.com