The enigmatic world of Bitcoin continues to captivate investors with its price fluctuations. However, a recent analysis by Cryptorphic, a prominent crypto analyst, suggests the future might be brighter than recent dips might indicate.

Their prediction? Bitcoin hitting a staggering $156,000 by May 27th, 2025.

The Halving Effect: A Historical Catalyst

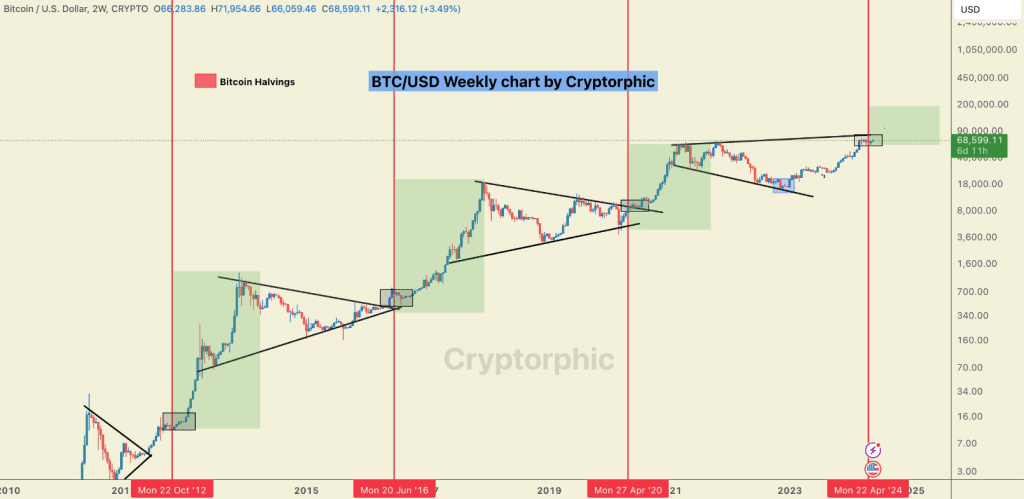

Cryptorphic’s prediction hinges on a historical phenomenon known as the halving. Every four years, the number of Bitcoins rewarded for mining new blocks is cut in half. This, in theory, reduces the supply of new coins entering the market, potentially driving up the price of existing ones.

His analysis examines past halvings, showcasing a fascinating trend. Following the first halving in 2012, Bitcoin’s price skyrocketed a mind-blowing 8,300%. The second halving in 2016 saw a more modest but still impressive increase of 288%. The most recent halving in 2020 sparked a 540% surge within a year.

#Bitcoin could hit $156,000 by May 27 2025!

These green boxes represent the price action after #BTC halvings. We’ve never seen a red year after a halving.

Bitcoin halvings are significant events, here are the percentages of Bitcoin’s price increase one year after each halving… pic.twitter.com/QEmNN8OuP2— Cryptorphic (@Cryptorphic1) May 27, 2024

A Golden Ticket Or Fool’s Gold?

Following the fourth halving last April, Cryptorphic predicts a potential price surge of nearly 130% by the following year. This translates to a price tag of anywhere between $115,000 and $156,000.

Despite the bullish outlook, the analysis acknowledges the current short-term volatility. Bitcoin is currently trading below its peak, reflecting a recent 5% dip. However, Cryptorphic identifies a technical indicator, the “inverse head and shoulders” pattern, suggesting a potential breakout for the price.

A Broader Market View

The analyst’s perspective doesn’t shy away from presenting contrasting viewpoints. Others take a more nuanced approach, expressing cautious optimism for the short-term trajectory. They acknowledge the diminishing bearish scenarios and believe the market might be in an earlier bullish phase compared to Cryptorphic’s prediction.

This suggests the potential for further gains even before 2025, although both analysts emphasize the importance of a measured approach to risk management.

Related Reading: Floki Floats 22% On Marketing Blitz, Aims For ‘World’s Most Used Crypto’ Title

Over the past year, Bitcoin has surged by 144%, demonstrating significant upward momentum. This impressive performance has allowed it to outperform 58% of the top 100 crypto assets, as well as surpass Ethereum in gains. Such a robust increase underscores the asset’s strong market position and investor confidence.

Currently, the asset is trading above its 200-day simple moving average, indicating a sustained bullish trend. Additionally, its high liquidity, supported by a substantial market cap, further enhances its attractiveness to investors.

Featured image from Revolutionized, chart from TradingView